What these businesses are doing is filling out the paperwork for an income-driven repayment plan or applying for federal consolidation on your behalf all while charging you a fee after the process is complete. This company will often tell you that there is a processing fee or administrative fee that needs to be paid.

Beware Of These Student Loans Forgiveness Scams In 2021

Beware Of These Student Loans Forgiveness Scams In 2021

A company calls you and offers to consolidate the student loans that you have.

Student loan consolidation companies scams. These are more often than not student loan scams. The company you reached for will charge a consolidation fee without doing anything. This fee goes by different names as well.

Whether you are consolidating your federal loans for program eligibility or consolidating on the private market for a lower interest rate the cost to you should be 0. 7500 - 125000 in undergraduate student loan debt 7500 - 175000 for graduate Graduated from cuGrad eligible school. They may offer to eliminate your balance or handle all the paperwork for you.

Student Loan Repayment. However the agency contracts only with certain private. Another red flag is if the company you are working for asks for your FSA ID or FSA PIN.

They require you to pay up-front or monthly fees for help. This is a scam. The Federal Trade Commission FTC has taken legal action against the following student loan debt relief companies.

You pay the money the firm does nothing at all and is shut down 6 months later. The fee is sometimes called processing fees administrative fees or consolidation fees. This is a scam for three reasons.

There are currently four Income Driven Repayment Plans. The scam works like this. A student loan company claims it will consolidate student loans and lower your monthly payments.

Reliable steady income of at least 2000 gross per month. The company will reassure you that. Some scam agencies will call it a processing fee or an administrative fee.

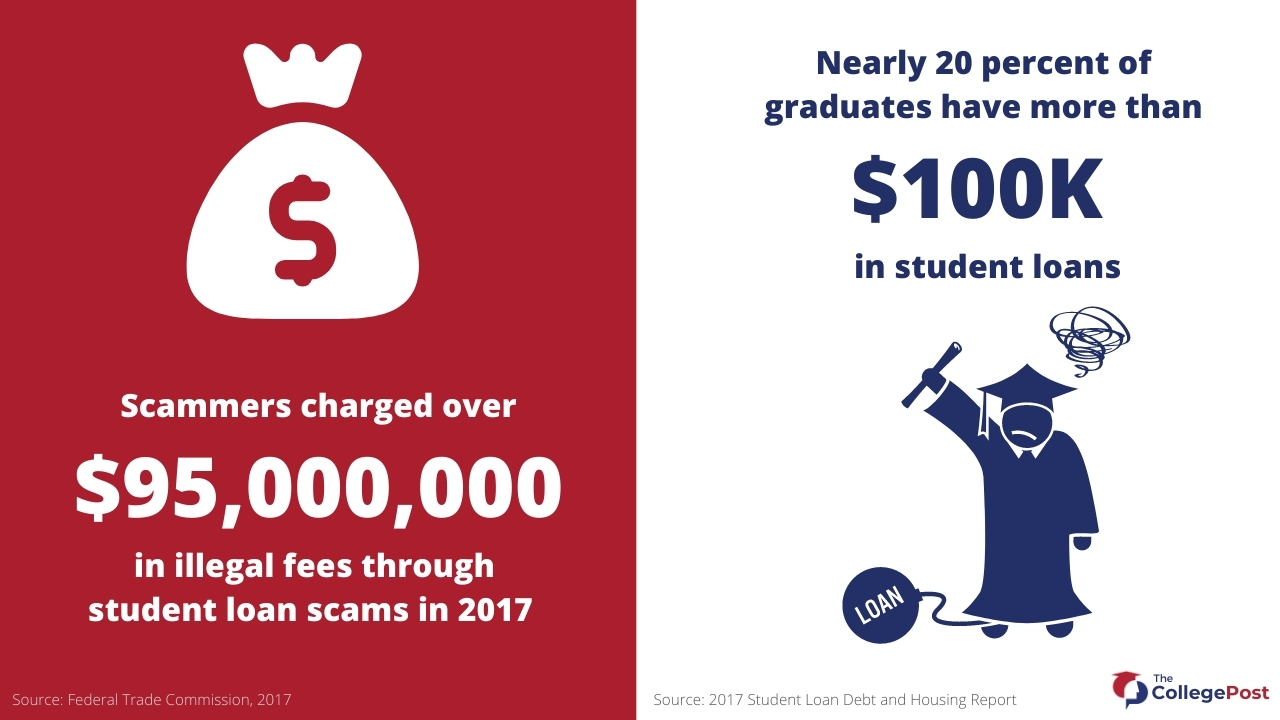

Student loan relief scammers jump on this by offering instant help consolidating loans andor lower payments. American Student Loan Consolidators ASLC. For example the firm might advertise student loan forgiveness or lower student loan payments They charge you hundreds of dollars and say they can do it but in reality dont actually do anything at all.

These companies are not in business to help you. The Student Loan Consolidation Scam is one of the most common scams making victims every year. Scam companies are student loan assistance companies who charge you for a service and then never do it or dont do it 100.

As for private loans this kind of. These include Income Contingent Income Based Pay As. Its illegal for a company to charge you an upfront fee before they perform a.

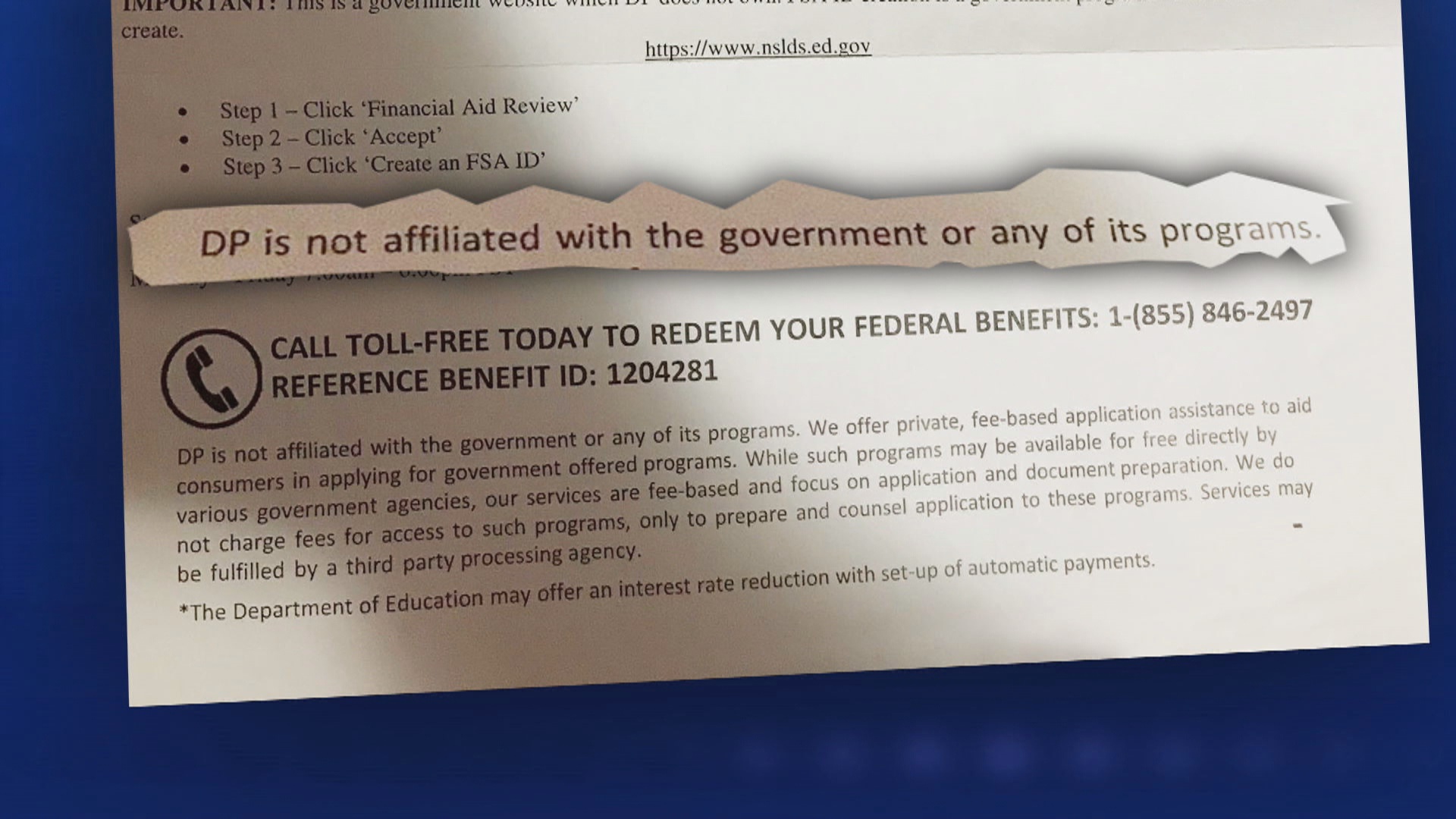

They hire commissioned sales pe. Student loan scammers love to charge upfront frees for your student loans. These companies will e-mail call or send letters to borrowers using official-sounding language.

Fraudulent student loan relief companies have been known to deceive borrowers by feigning relationships with the Department of Education. The consolidation company may move you into a private student loan that is worse for you than your original loans. Keep in mind that federal student loans dont charge any fees.

Student Loan Consolidation Scams If you are paying for this service it is almost definitely a scam. It is illegal to charge an up-front fee for this type of service so if a company requires a fee before they actually do anything thats a huge red flagespecially if they try to get your credit card number or bank account information. Income-Driven Repayment IDR Plan Scam.

Here are some signs to help you identify a scam by a student loan debt relief company. The scam is when companies make promises about loan consolidation that are either not true or cannot be kept. You may have been contacted by a similar company.

If you have a federal student loan there are no fees whatsoever for student loan debt consolidation. One of the most common student loan scams is the student loan consolidation scam and every year students fall victim to it. What these companies do is fill out paperwork for an income-driven repayment plan or apply for federal consolidation on your behalf and charge you a fee even though you could do this for free.

They Charge An Application Fee For Student Loan Consolidation. The consolidation company. The ideal candidate for the cuGrad Student Loan Consolidation has.

The most common student loan consolidation scam is one in which the company charges a consolidation fee but actually does nothing. Student loan relief scammers offer instant help by consolidating loans andor lowering payments. These companies are not in business.

The Student Loan Consolidation Scam. Federal student loans can only be consolidated through the Federal Direct Consolidation Program. You can do this.

This is what a student loan scam looks like according to the Federal Trade Commission which in February 2021 announced a 17 million settlement with.

How To Avoid Student Loan Consolidation Scams Student Loan Planner

How To Avoid Student Loan Consolidation Scams Student Loan Planner

If You Ve Got Student Loan Debt You Ve Probably Seen Ads Or Been Contacted By Companies Promising They Can Help Student Loans Student Loan Debt Debt Relief

If You Ve Got Student Loan Debt You Ve Probably Seen Ads Or Been Contacted By Companies Promising They Can Help Student Loans Student Loan Debt Debt Relief

Education Loan Watch For Warning Signs Of Student Loan Company Scams

Education Loan Watch For Warning Signs Of Student Loan Company Scams

How I Almost Fell Victim To A Student Loan Scam Timothy Weisberg

Scam Alert Student Loan Reduction And Forgiveness By Mail

Scam Alert Student Loan Reduction And Forgiveness By Mail

The Most Common Student Loan Scams And How To Avoid Them

The Most Common Student Loan Scams And How To Avoid Them

The Most Common Student Loan Scams And How To Avoid Them

The Most Common Student Loan Scams And How To Avoid Them

5 Tips To Avoid Student Loan Payment And Forgiveness Scams Forbes Advisor

5 Tips To Avoid Student Loan Payment And Forgiveness Scams Forbes Advisor

/cdn.vox-cdn.com/uploads/chorus_image/image/64062096/1_Ty-3N4XfL6a7F_p1N0HQGA.0.0.0.jpeg) Inside The Obama S Student Loan Forgiveness Scams The Ringer

Inside The Obama S Student Loan Forgiveness Scams The Ringer

Common Student Loan Scams And How To Protect Yourself

Common Student Loan Scams And How To Protect Yourself

Student Loans Ftc Consumer Information

Student Loans Ftc Consumer Information

Scam Alert You May Qualify For Student Loan Forgiveness But You Shouldn T Have To Pay A Fee For It

Scam Alert You May Qualify For Student Loan Forgiveness But You Shouldn T Have To Pay A Fee For It

How To Avoid A Student Loan Consolidation Scam Company

How To Avoid A Student Loan Consolidation Scam Company

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.