In this mental model for investing volatility is the when for investing. There are two basic volatility strategy categories one grouping is funds intended as portfolio solutions that combine equities SP500 and a volatility hedge.

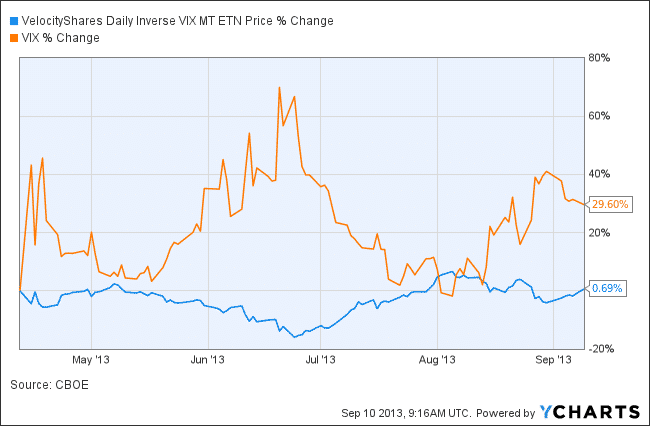

Invest In Volatility Comparison Of Vix Volatility And Ziv Return

Invest In Volatility Comparison Of Vix Volatility And Ziv Return

2011-217 CAGR 54 Max DD 28 No year of loss.

How to invest in volatility. That could put them out of reach for the everyday investor. Volatility indexes are tools investors can use to estimate future volatility of the market. On top of a diversified asset allocation diversifying your volatility investment across volatility signals can help smooth returns and improve your risk adjusted returns.

This is a nuance applicable to traders seeking to profit from various time periods of expected volatility of the VIX futures markets. One of the most popular volatility indexes available is the EURO STOXX 50 which is a stock index specific to Eurozone equities. Volatility is commonly used as a proxy for risk although strictly speaking it is just one type of risk investors face.

Finally some managed volatility funds can have a higher barrier to entry when it comes to the minimum initial investment. Besides volatility investors face counterparty risk liquidity risk credit risk inflation risk horizon risk and longevity risk. Since it relates to price movements we can use it to determine when to apply.

This index is composed of 50 of the largest. For investors with cash available to invest Haefele suggests dollar-cost averaging using a set schedule which would relieve the investor of the task of trying to time the market. How to Invest in Low Volatility Markets - Trading with the VIX under 15.

While the research concludes that there is little to choose between the various strategies you should know what matters to you as an investor. The greater the price volatility the less accurate the market was at predicting an assets future price. For better comparison you will find a list of all low-volatility ETFs with details on size cost age income domicile and replication method ranked by fund size.

USMV which looks to invest in stocks that are less volatile than the market as a whole. Rather than focusing on if the price is moving up or down volatility traders are concerned about how much. In a straddle strategy a trader purchases a call option and a put option on the same underlying with.

Price volatility is the change in a security or markets price over a given time period. While traditional mutual funds may only require 1000 to 3000 to invest some managed volatility funds require at least 100000 to invest. And more importantly understanding volatility can inform the decisions you make about when where and how to invest.

Simple solution is to invest 50 in XIV and 50 in this strategy every quarter leading to the following. If you dont like concentrated bets then err towards minimum variance. Some practitioners and portfolio managers seem to completely ignore or dismiss volatility forecasting models.

One of the most popular low-volatility funds as of February 2021 is the iShares MSCI Minimum Volatility ETF NYSE. Using Volatility Index VIX. The more a price or index moves the higher the volatility.

Its YTD return is 120. How to Profit from Volatility Straddle Strategy. This represented by PowerShares PHDG The other fund Barclays XVZ is a straight volatility play.

Since it relates to price movements we can use it to determine when to apply. The funds expense ratio is 089. Similar funds include the Invesco SP 500 Low Volatility ETF NYSE.

When choosing a low-volatility ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. SPLV and the Fidelity Low Volatility Factor ETF NYSE. If return is all that counts then naive low volatility may be the way to go.

Be Proactive To keep Volatility Risk Premium and Futures Risk Premium in your favor it is imperative to remain systematic properly scale your exposure and be willing to go long or short volatility frequently and often. And the higher the volatility the higher the risk. Many of these risks can be mitigated by doing thorough research and through diversification.

Volatility trading is the buying and selling of securities based on their expected volatility. Its design attempts to minimize losses when the market is quiet and take make dramatic gains when volatility really spikes. In this mental model for investing volatility is the when for investing.

The greater the price volatility the less accurate the market was at predicting an assets future price. Types of volatility There are two types of market volatility. And for folks.

If playback doesnt begin shortly try restarting your device. The cost of the. A long straddle position is costly due to the use of two at-the-money options.

XVZ provides investors with exposure to implied volatility by dynamically allocating positions between both short-term futures contracts and mid-term futures contracts.