You have to wait 6 months since your most recent closing usually 180 days to refinance if youre taking cash-out or using a streamline refinance program. Sometimes the owner-occupancy clause is open ended with no expiration date.

5 Biggest Myths About Mortgage Refinancing Bankrate Com

5 Biggest Myths About Mortgage Refinancing Bankrate Com

Planning to sell your home within five to 10 years will affect which type of mortgage refinance is best for you.

How long before you refinance your home. You need to put up enough. A great breakeven point for deciding whether to refinance is 18 months or less. If you want to do a rate and term refinance on one FHA loan to another FHA loan via the most common streamline refinance method the waiting period is 210 days and six monthly mortgage payments must have been made.

Before you decide on refinancing your TD Mortgage or a TD Home Equity FlexLine be sure to look at all potential costs. Therefore it is in the best interest of the borrower to check with the specific lender for all restrictions and details. For example if you have a number of outstanding debts such as a car loan a line of credit or credit card bills you may be able to consolidate this debt through the variety of mortgage refinance options available.

Typically youll need to wait six to 12 months between getting a mortgage and seeking to refinance. How to get the best rates when refinancing your mortgage. If you have enough equity in your home you might be able to use built-up equity in your home to pay-out high-interest debt through a mortgage refinance.

According to the Jennifer Beeston an expert from Guaranteed Rate Mortgage every mortgage lender is different but the average refinance takes 20 to 45 days. If your appraisal value puts your home equity at less than 20 youll get stuck paying for private mortgage insurance PMI or having to bring some cash to the table to do a cash-in refinance. Therefore before you approach a lender you must first determine whether you have a good enough reason to apply for a loan.

But if youre able to take advantage of lower interest rates your overall savings may make it worthwhile. But before you take the leap there are a few things to consider. You may even realize that refinancing is not worth the cost and hassle because you wont be staying in the home long enough to break even on the closing costs.

Some types of government-backed loans dictate that you cannot refinance until you live at least 1 year in your home. To find out if you qualify your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your property into the current value of your property. Compare how much it cost you to refinance to how much youll save each month.

If you do decide to refinance choose a no-closing-cost refinance. An owner-occupancy clause can require you to live in your house for 6-12 months before you sell it or rent it out. Prepayment charges may apply if the agreement is ended before the term is done.

Refinancing Length in a Nutshell. The following examples are considered valid reasons to apply for mortgage refinancing. If you sell your house before the owner-occupancy clause in your contract expires you may run into problems with your mortgage company during closing.

You are planning to renovate your house. If you are unsure of what your credit score is you should get your report before submitting your loan application. Although brokers and lenders dont accept consumer-pulled reports its important for you to understand your current credit score.

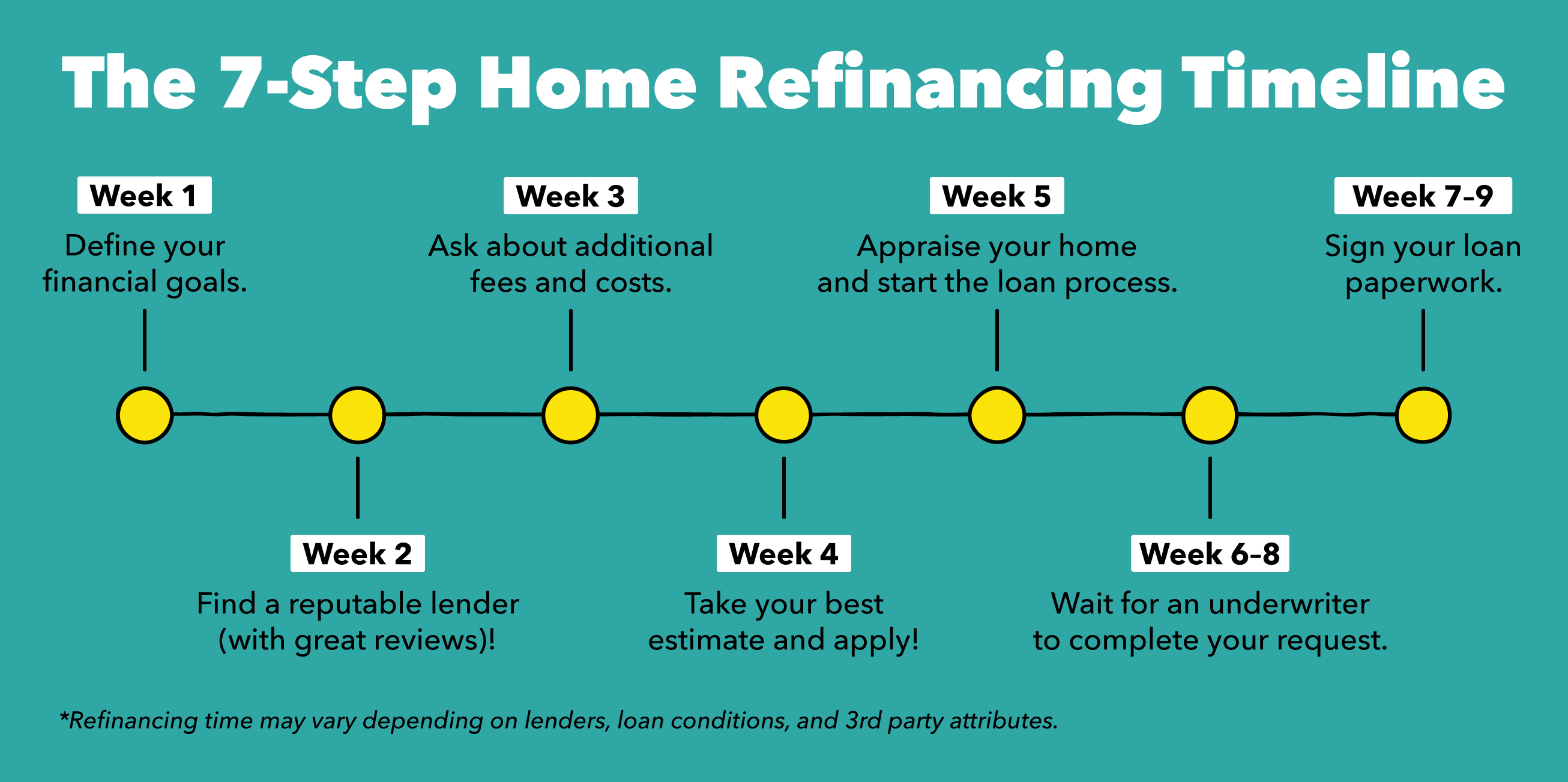

Before you start the process however lets take a look at exactly how long you can expect the refinance application and closing to take from start to finish. If the loan cost you 4000 in closing costs and it saves you 100 a month on your mortgage payments youll actually lose money if you sell and vacate before 40 months have passed more than three years. There may also be associated fees for mortgage registration and property valuation.

In other words in 18 months or less the savings you get from refinancing your mortgage will start being greater than the cost of refinancing a mortgage. If youre refinancing to eliminate private mortgage insurance you may have to wait two years. When you refinance your mortgage you replace your existing mortgage with a new one on different terms.

There must also be a net tangible benefit such as a mortgage rate 05 lower or a reduced loan term that saves the borrower money. If your loan-to. However lenders such as Quicken Loans.

You are thinking about buying a new property. Its essential that you understand your score because it can have such a significant bearing on your ability to get approved for a loan. Most banks and lenders will require borrowers to maintain their original mortgage for at least 12 months before they are able to refinance.

Refinancing your mortgage is a serious and long-term commitment. Although each lender and their terms are different. The answer really is as often as you can to save money.

Additionally your lender may charge you a prepayment penalty if you refinance and then quickly sell your home.