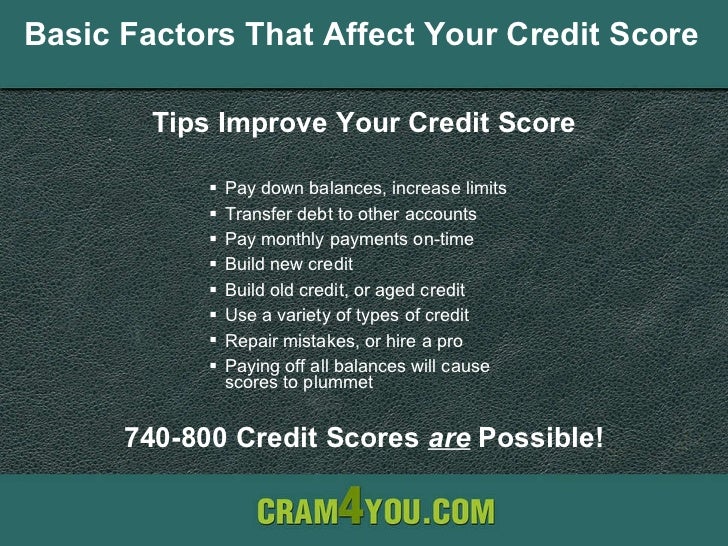

Avoid spending money on credit repair and take tried-and-true steps to improve your score instead like lowering debt balances and paying your bills on time. It lets you share information about your regular spending such as payments to savings accounts Council Tax payments and digital entertainment payments to the likes of Netflix and Spotify.

5 Sneaky Ways To Improve Your Credit Score Clark Howard

5 Sneaky Ways To Improve Your Credit Score Clark Howard

Add Rent Payments to Your Credit Report.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)

Can you pay to boost your credit score. If youre making regular payments such as a phone or energy contract you will be building up your credit history. Heres how to sign up and potentially boost your credit score. Experian Boost is free and lets you get credit for on-time utility telecom and Netflix payments.

If you have credit cards with a high level of credit utilization an installment loan that helps you pay off your credit card balances could boost your credit scores significantly within a matter of months. You make monthly payments into an interest-bearing certificate of deposit CD for up to 24 months. That is you should maintain a balance of no more than 3000 on a credit card with a limit of 10000.

However you will have to pay much more than the minimum all the way up to a total payoff before making the kind of utilization dent that can raise your score. Pay down debt and you may see your credit score rising in a hurry. In fact together these two categories represent 65 of your credit score payment history 35 and credit utilization 30.

The entire process only takes about five minutes and any boost to your score will be immediate. In fact 30 of your credit score points are based on that debt-to-credit-limit ratio. Paying the minimum payment on time each month is certainly enough to maintain a positive payment history.

You could also take out a credit card and if you repay it each month it will. Credit builder loans can offer a small credit score boost as you lend money to yourself. Making your payment a few days earlier than the due date each month.

Under the FICO score model its best to keep your credit utilization rate below 30. If you pay your credit back on time every single month your payment records and history will get a boost. If youre making payments like this regularly and not spending more than you.

As a result when you begin to pay down your credit card balances lowering your revolving utilization ratios your credit scores will generally begin to climb. If you have a history of on-time payments for your cellphone utility bills or even your Netflix account you can use Experian Boost to add those payments to. With your permission those on-time payments are added to your Experian credit report which can bolster your payment history and could help improve your FICO Score.

If you regularly pay rent on time add those payments to. Strategically paying down debt and paying all of your bills on time are two of the most powerful techniques for raising a credit score. The common advice is to.

Below CNBC Select takes a look at how paying off credit card debt can improve your credit score. Most experts suggest keeping your credit utilization below 30 of your available credit limits with utilization higher than that having the potential to hurt your score. 9 To meet that 30 target pay cash for purchases instead of putting them on your credit card to minimize the impact on your credit utilization rate.

How does a credit card help you get a good credit score. Paying off debt also lowers your credit utilization rate which helps boost your credit score. This is definitely the most significant as well as the most critical factor that will ultimately regulate and govern your credit score.

Therefore youll be a lot better off if you can pay down debt and reduce your utilization percentage. The best way to increase your credit score comes down to paying your bills on time or reducing your credit-card balance.

Simple Ways To Improve Your Credit Score

Simple Ways To Improve Your Credit Score

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

What Makes A Good Credit Score And How To Improve Yours

What Makes A Good Credit Score And How To Improve Yours

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

Improve Your Credit Score Save And Invest

Improve Your Credit Score Save And Invest

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Get A Better Credit Score Using These Tips Youtube

How To Improve Your Credit Score Get A Better Credit Score Using These Tips Youtube

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

Pdf Book How To Boost Your Credit Score 100 Points In 30 Days Wi

Pdf Book How To Boost Your Credit Score 100 Points In 30 Days Wi

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Improve Your Credit Score In 6 Months Blog Details Essex Bank

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

7 Easy Ways To Improve Your Credit Score This Month Money

7 Easy Ways To Improve Your Credit Score This Month Money

Bad Credit See 24 Steps To Have An Excellent Credit Score Fast

Bad Credit See 24 Steps To Have An Excellent Credit Score Fast

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.