The other reason why the copays and deductibles are so high is that American healthcare is expensive. For more info please check out our FAQ How are copays determined.

Dec 19 2012 - This Pin was discovered by Rinku Desai.

Why is my copay so high. You have insurance and supposedly it covers your medicines. After this set amount of money is reached your typical copay amounts return. In any event PBS recommends patients look at the terms of their insurance plans and do the math to determine whether it makes more sense to pay a higher copay for example if they have a high deductible it may make more sense so that you cover the deductible sooner and therefore insurance kicks in sooner or pay out of pocket for the occasional lower copay.

Usually you do not have to meet the deductible for office visits before you make a CO-PAY but I think you are thinking about CO-INSURANCE that 8020 or 9010 split or whatever you have after you meet your deductible that is different than a co-pay. Our plan has a fairly high deductible so we have to wait until midyear before we can pay just the copay for physician visits. Perusing the choices on United Healths website you play it safe avoid the plan labeled high-deductible and settle on the companys comprehensive plan so-called Copay Select.

Each medicare coverage is different since there are a variety of options for patients to choose from. Plans with higher premiums usually have lower copays. Pharmacy benefit managers usually take a.

Discover and save your own Pins on Pinterest. Name brand prescription medicine usually has a higher copay than generic versions. The plus side is that at least compared to Medicaid and Medicare patients private insurances generally cover more medications.

However you still get stuck with a portion of the bill that the insurance company calls a copay In some cases these copays can run more than 150 month per medication eg. Know your deductible your coinsurance and your out-of-pocket maximum. Germany pays around 10 of its GDP on healthcare and people have a wide choice of providers doctors etc.

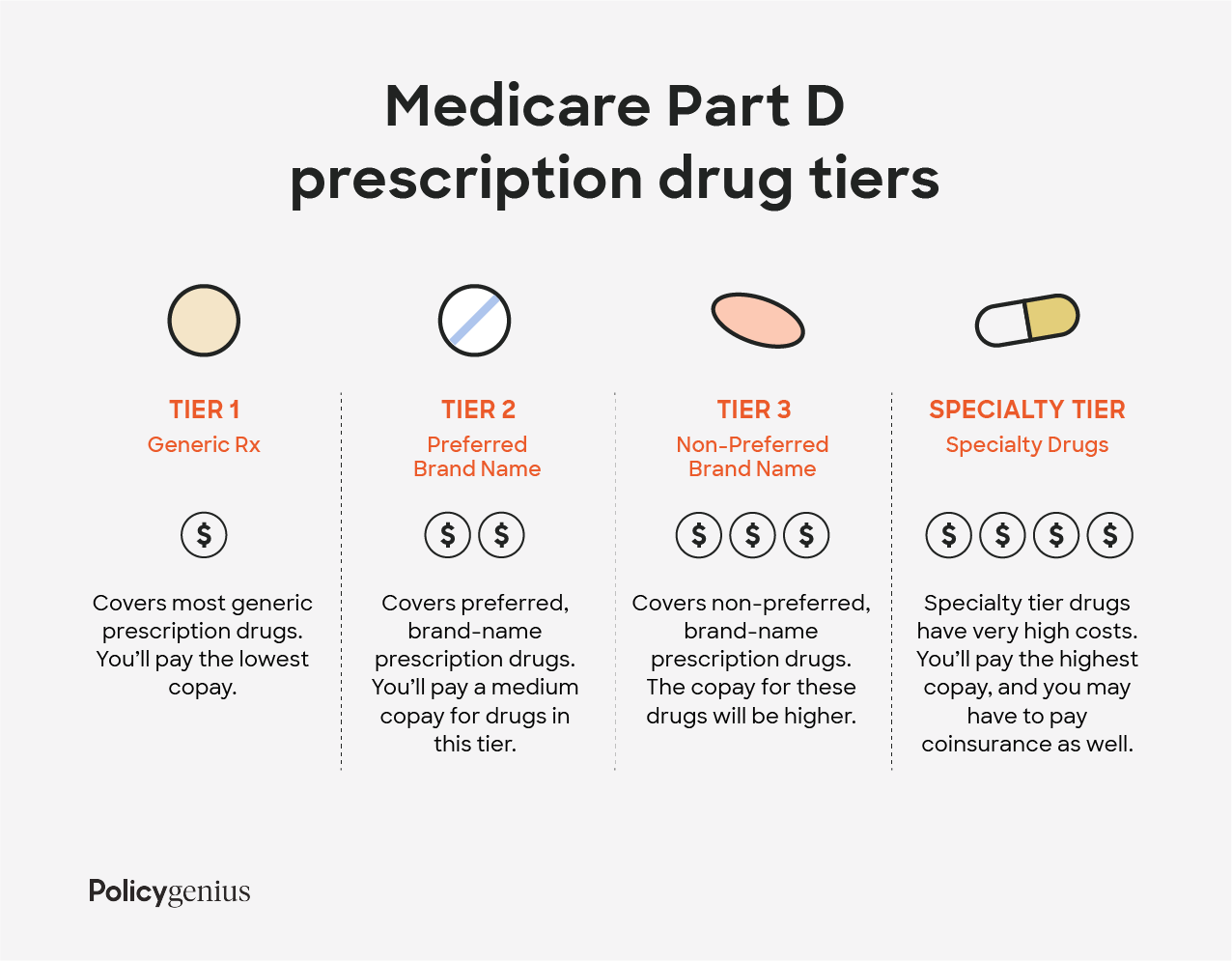

Understand your plan. Your co-pay generally decreases after you have paid your premium. Formularies often have tiers that determine what the copay will be with a tier one drug often being the cheapest and the higher tiers more expensive.

The hold harmless rule says that Part B premiums cant go up more than an. A lot of times private insurances tend to charge higher co-pays for medications especially brand-name medication. Sometimes the pharmacy can see the specifics of why your insurance determined the cost to be what it is but for the most detailed information have the pharmacy keep the prescription billed to your insurance and give.

Non-Preferred brand Brand-name drugs that may not have as much clinical value as drugs in Tiers 1 and 2 Safe and effective but with a shorter track record of safety and effectiveness compared to Tiers 1 and 2 Generic or preferred brand alternatives available for many of these drugs Highest copay. There are several reasons a copay may turn out high such as deductibles and brand name meds. As a general rule health insurance plans with lower monthly premiums the amount you pay each month in order to have health insurance will have higher copays.

The price will be higher if you have a deductible are in the Medicare coverage gap are using non-formulary drugs or youre paying a percentage instead of a flat copay. In addition you may have premiums or deductibles to pay before your co-pay is lowered. Were happy to work with you and your Doctor to see if there may be an effective cheaper alternative medication.

So I am gaming with an i7 - 4770 a cpu which is not supposed to be overclockable. However lately it is always clocking at about 374 - 385 GHz without me having. If you are covered under Medicare it is best to look over or have.

The first and most common reason involves that of a deductible in which the member will pay the majority of the cost of their medications until a certain amount of money has been spent usually 200 or 320. To keep up with inflation Social Security benefits are adjusted annually for increases in cost of living COLA. Depending on what Medicare Part D coverage you have signed up for you may have premiums on top of your co-pay.

Be sure to know which of your providers are in-network as. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. It does however have a turbo clock and that brings it up to 39 GHz from the regular 34GHz it normally employs as a maximum speed.

Copay Assistance Programs Help Patients But Confuse Them Too Medpage Today

Copay Assistance Programs Help Patients But Confuse Them Too Medpage Today

Why Your Health Care Costs Are So High Even If You Re Insured

Why Your Health Care Costs Are So High Even If You Re Insured

What Is A Copay Examples Of When You Owe A Copay

What Is A Copay Examples Of When You Owe A Copay

Your Doctor Copays Are Too High Salon Com

Your Doctor Copays Are Too High Salon Com

:max_bytes(150000):strip_icc()/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Were Individual Market Health Plans Less Expensive Before Obamacare Healthinsurance Org

Were Individual Market Health Plans Less Expensive Before Obamacare Healthinsurance Org

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

Repatha Evolocumab Cost Copay Information

Repatha Evolocumab Cost Copay Information

8 Health Insurance Terms Explained Nwpc

8 Health Insurance Terms Explained Nwpc

Drug Channels Employer Pharmacy Benefits In 2017 More Cost Shifting To Patients As Tiers And Coinsurance Expand

Drug Channels Employer Pharmacy Benefits In 2017 More Cost Shifting To Patients As Tiers And Coinsurance Expand

Why A Patient Paid A 285 Copay For A 40 Drug Pbs Newshour Weekend

Why A Patient Paid A 285 Copay For A 40 Drug Pbs Newshour Weekend

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.