Each five-year segment such as age 65 to 70 and 70 to 75 has its own unique lifestyle needs and therefore investment needs. It basically said that if you want a very high probability that your money will last at least 30 years in retirement you can only spend about 4 of it a year.

I Am 20 Years Old And Want To Invest In Mutual Funds How Can I Get The Maximum Return For An Investment Of 3k Per Month Quora

I Am 20 Years Old And Want To Invest In Mutual Funds How Can I Get The Maximum Return For An Investment Of 3k Per Month Quora

Lets say you invest 300 per month starting at age 20 and dont stop until youre 60-years-old.

Investing at 70 years old. Legally banks are only allowed to offer loans based upon financial qualifications. If you managed an 8 percent return during that time you would have more than 1 million. The closer you get to your retirement years and claim your status as a senior citizen the fewer risks you may want to take with your investments.

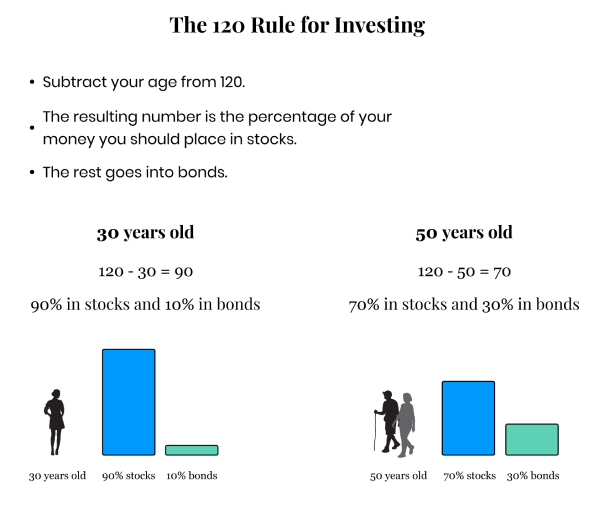

You have to run a tax projection each year to determine what might be best. Although theres no single investment strategy that works for everyone he recommends that seniors begin by considering the rule of 100 This approach requires you to subtract your age from 100. The Plan for How You Invest 1.

It depends on your circumstances because it might be better to touch the Roth a little bit sooner to avoid huge withdrawals from traditional accounts when you have to take money out at age 70. The result is a conservative recommendation for how much of your portfolio should be invested in stocks. This can give 65-year-olds some leverage when applying for a mortgage.

Let me explain why. The IRS allows people approaching retirement to put more of their income into investment accounts. Workers who are 50 and older can contribute an additional 6500 per year to a 401 kcalled a.

Safe short term and no risk. Remember the Trinity Study with its 4 rule. Rebalance your assets at least once a year when youre in retirement so that you have the appropriate amount in stocks bonds and cash as well as all of their subcategories for your age and risk tolerance.

The sooner you get. They have s good income coming in from pensions about 30000 total per year. If you had lower income years before reaching age 72 it could make sense to withdraw money from retirement accounts and pay little to no tax.

Check required minimum distributions. If you are eligible for a traditional or a Roth IRA as well putting extra money aside in those plans can lower your tax bill and boost your retirement savings. If you are reading this and berating yourself for never.

If you meet certain income guidelines you can invest up to 6000 in after-tax dollars or 7000 if youre older than 50. Can a 70- year-old get a 30-year mortgage. The average gain during the up years was almost twice as much as the average loss in the down years.

With rates scraping bottom and lifespans lengthening a 100000 investment in a joint-life immediate annuity will return 475 per month to a 66-year-old couple who want payments to. You may be looking at a smaller fixed income. However if you feel that you will need greater liquidity and access to your funds over the coming years you may want to invest a portion of your money in.

Starting the year you turn 70½ you have to take withdrawals known as required minimum distributions from any pretax retirement. Regardless at 72 you will have to start taking withdrawals or required minimum distributions RMDs from your IRA SEP IRA Simple IRA and 401k. Because should the market take a major tumble you have little time to make up what youve lost.

Let me tell you a story about Mr. This means that when the market went up an investor. Jones not their real names from Qualicum.

As a 53-year-old investor you should be taking full advantage of every tax-deferred investment for which you are eligible. For example if youre age 65 youd want 35 of your total retirement portfolio invested in. However an 83.

However while you are working banks can look at. Make sure you have documentable and stable income and assets to satisfy the credit requirements for the loan program you are applying for. 1 The advantage of the Roth is that the money grows tax-deferred and unlike the 401 k you wont owe any taxes if you withdraw the funds in retirement.

Actually most 75 year olds invest the same way as 65 year olds just a little more cautious. If your employer offers a 401k or 403b plan put as much as you can into that account. While the income needportfolio size ratio 6 might not seem large to a 60 year old it is quite good for an 83 year old.

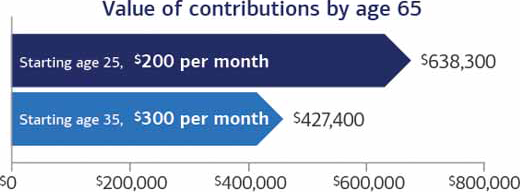

9 Charts Showing Why You Should Invest Today Investing 101 Us News

9 Charts Showing Why You Should Invest Today Investing 101 Us News

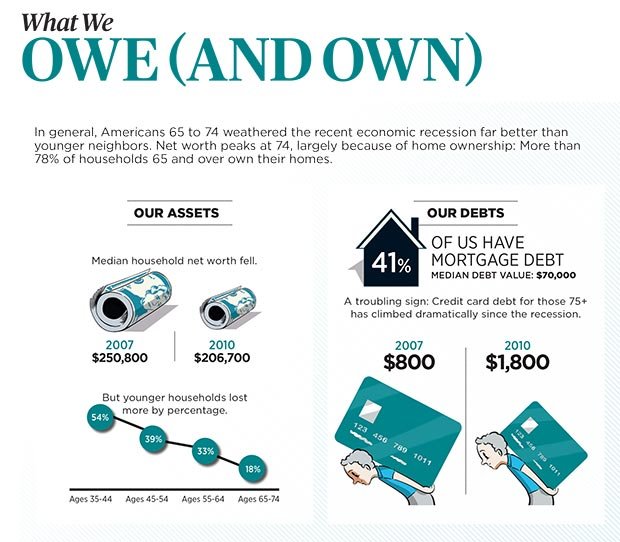

A Pocket Guide To Your Money And Personal Finance At Age 70 Aarp

A Pocket Guide To Your Money And Personal Finance At Age 70 Aarp

A Pocket Guide To Your Money And Personal Finance At Age 70 Aarp

A Pocket Guide To Your Money And Personal Finance At Age 70 Aarp

What Is The Best Investment Strategy For A 25 Year Old Quora

What To Do With 10k The Ultimate Plan For A 70 Year Old Investor

What To Do With 10k The Ultimate Plan For A 70 Year Old Investor

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

10 Ways To Help You Boost Your Retirement Savings Whatever Your Age

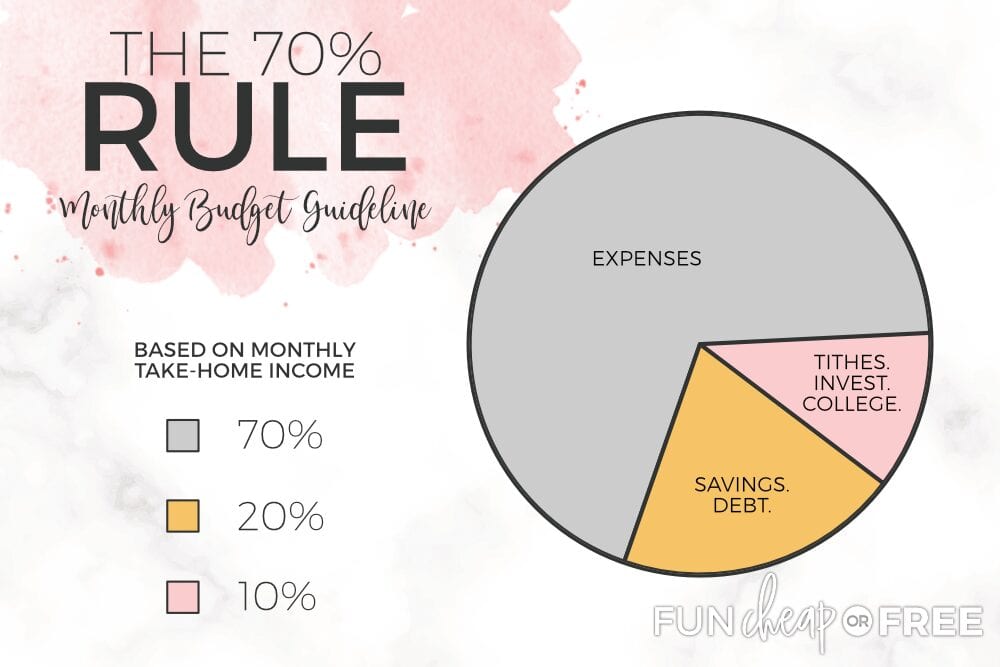

70 20 10 Budget Rule Spend Save Invest Fun Cheap Or Free

70 20 10 Budget Rule Spend Save Invest Fun Cheap Or Free

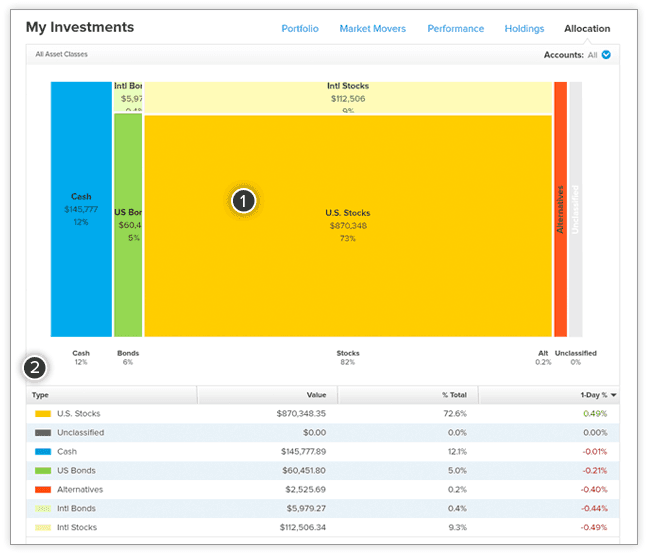

The Proper Asset Allocation Of Stocks And Bonds By Age

The Proper Asset Allocation Of Stocks And Bonds By Age

The Effect Of Compounding Amg Funds

The Effect Of Compounding Amg Funds

Asset Allocation For Young Investors Money Under 30

Asset Allocation For Young Investors Money Under 30

Value Investing Is Struggling To Remain Relevant The Economist

Value Investing Is Struggling To Remain Relevant The Economist

Investment Lifecycles Befrank Com

Investment Lifecycles Befrank Com

A Complete Guide To Investing For Beginners Resources Tips

A Complete Guide To Investing For Beginners Resources Tips

/content-assets/ad70d2eb3ad34e9a8b2393460463b170.png) What Is The 100 Minus Age Investment Allocation Rule

What Is The 100 Minus Age Investment Allocation Rule

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.