If you dont buy your health insurance during open enrollment youll have to wait until the next years open enrollment for another opportunity. You may be fined at tax time if you dont have health insurance in those states.

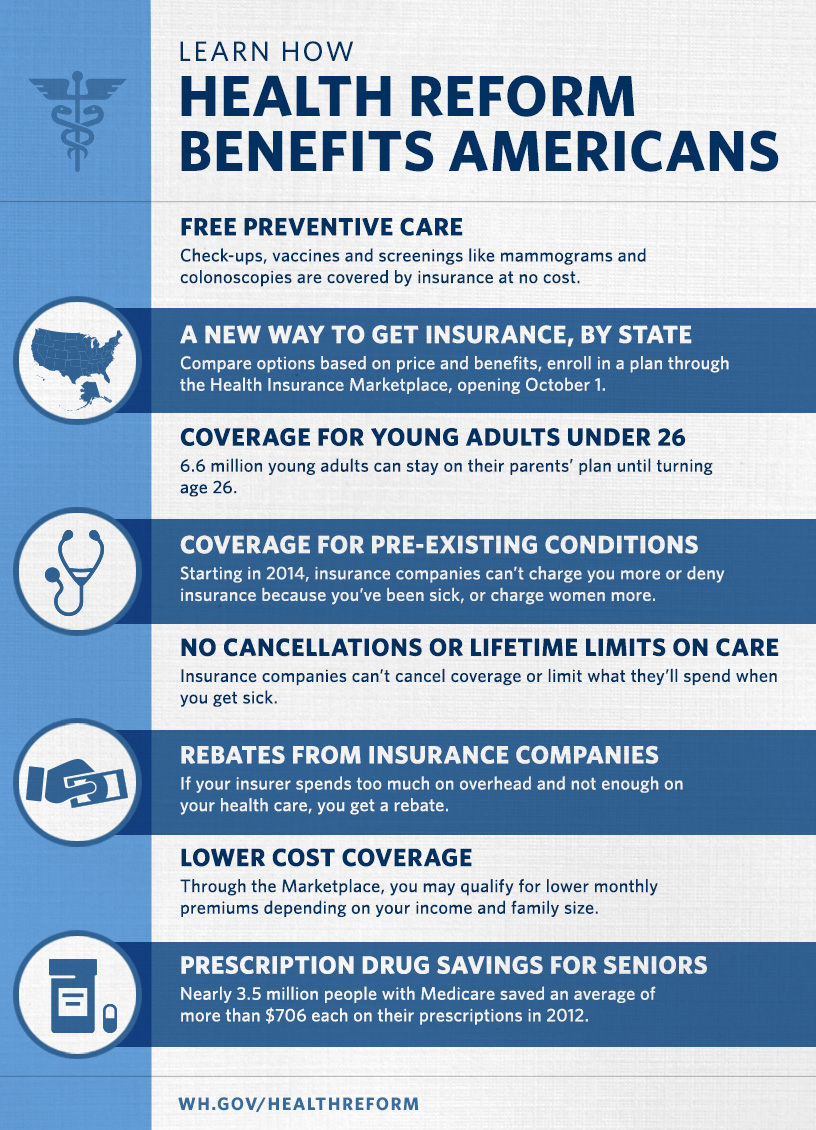

Understanding The Affordable Care Act Don T Drop Health Insurance

Understanding The Affordable Care Act Don T Drop Health Insurance

It usually takes place in the fall.

What happens if you don t enroll for health insurance. If youre uninsured dont expect free medical care in the event of an accident. There are government subsidies available depending on your income that can reduce the cost of insurance. If you have not already signed up for health insurance theres a good chance you wont be able to do so this year.

You also can enroll in a job-based plan when you undergo a certain type of life event called a qualifying status change. You have 60 days from your entry on duty date to sign-up for a health insurance plan. Such events include losing health coverage from a spouses job getting married getting divorced and having a baby.

A health plan cannot limit or deny benefits or coverage for a child younger than age 19 due to a pre-existing condition. What happens if I dont have health insurance. 1 That means you wont have to pay a federal tax penalty if you fail to enroll in minimum essential coverage for 2019.

Until recently if you didnt enroll in minimum essential coverage and were not exempt from the mandate you could owe a federal tax penalty known as the shared responsibility payment. But your coverage wont be anywhere near a. Even if you think you wont qualify consider applying for Medicaid during open enrollment.

While opt-out arrangements may be legal there are a few facts that businesses should bear in mind. However if your income makes you eligible for the Obamacare premium subsidies its essential that you enroll through your states marketplace during open enrollment or a special enrollment period triggered by a qualifying event like losing access to your employer-sponsored health insurance. If you miss your 60-day window to enroll youll have to wait until Open Enrollment Period unless you have another qualifying event which isnt until November.

The period of open enrollment has become shorter. Starting with the 2019 plan year for which youll file taxes in April 2020 the Shared Responsibility Payment no longer applies at the federal level. Heres what you need to know about paying employees who opt out of health insurance.

It should also be noted that since health insurance is now guaranteed-issue pre-existing conditions arent a barrier to enrollment coverage can only be purchased during open enrollment or during a special enrollment period triggered by a qualifying event. But if you were already enrolled last year your plan likely automatically renewed for this year if you didnt make any changes during your employers open enrollment period. If you apply for Medicaid during the Open Enrollment Period and are denied you have 60 days following the denial to enroll in another health insurance plan.

In this case your new coverage can take effect the first day of the month after you enroll in a new plan. What happens if you dont enroll for coverage. Prior to this you would pay a fee called the individual shared responsibility payment when you filed your federal taxes if you did not purchase health insurance.

As long as youre not in a state that has its own penalty for people who go without minimum essential coverage youre free to purchase a plan thats not compliant with the ACA and you wont be penalized for doing so. Even if your state. If you do not enroll for the coverage when you are first eligible and try to enroll later your existing medical conditions may not.

According to Group Health Solutions cash in lieu of health insurance. If you get sick in the meanwhile youll probably be out of luck. You need to sign up for health insurance during open enrollment but there are a limited number of ways that you can get health care during other parts of the year.

Otherwise youre missing out on comprehensive health insurance and a tax credit. However if you went without minimum essential coverage in 2018 and were not exempt from the individual mandate you could owe the penalty when you file your. The federal tax penalty was eliminated effective Jan.

Special enrollment for health insurance. If you dont enroll during open enrollment youre eligible. If you dont make an election you are considered to have declined coverage and you must wait until the next Open Season to enroll.

You to show you have had prior health insurance. When the Affordable Care Acts ACA otherwise known as Obamacare individual mandate took effect in 2014 so did the penalty for going without health insurance. If you didnt enroll at hiring you can enroll during open enrollment.

Can I Keep My Health Care Plan Under Obamacare

Can I Keep My Health Care Plan Under Obamacare

Obamacare 2018 What Happens If You Don T Enroll

Obamacare 2018 What Happens If You Don T Enroll

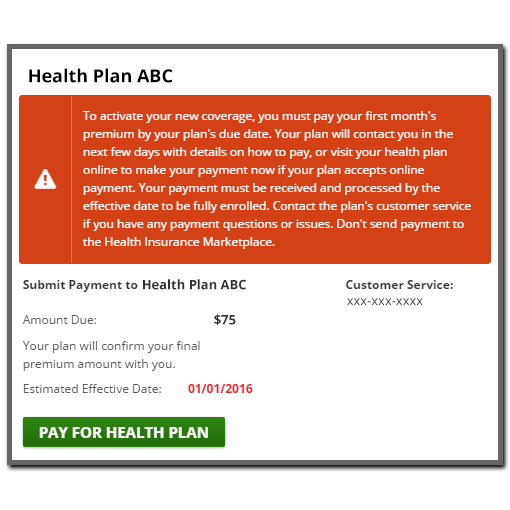

Don T Forget To Pay First Month S Premium Healthcare Gov

Don T Forget To Pay First Month S Premium Healthcare Gov

Health Insurance Application Process

Health Insurance Application Process

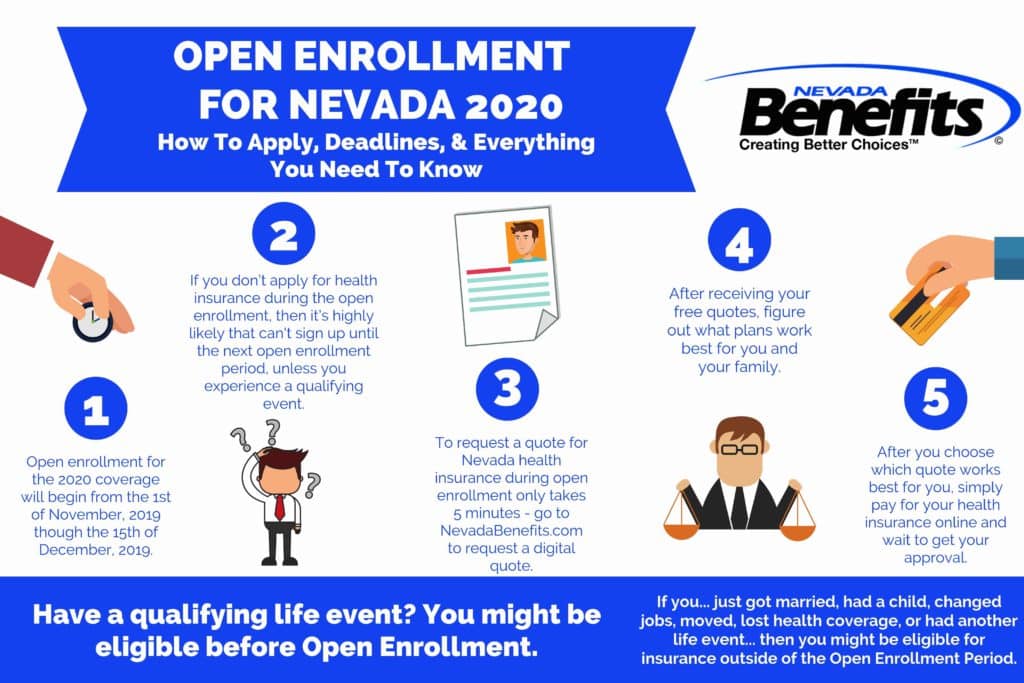

2020 Open Enrollment Guide For Individuals Families Groups Deadlines Special Enrollment And More Las Vegas Individual Group Health Insurance Plans Call Now 702 258 1995

2020 Open Enrollment Guide For Individuals Families Groups Deadlines Special Enrollment And More Las Vegas Individual Group Health Insurance Plans Call Now 702 258 1995

Open Enrollment 2021 Guide Healthinsurance Org

Open Enrollment 2021 Guide Healthinsurance Org

Optimize Your Medical Health Insurance By Using These Effortless Reco

Optimize Your Medical Health Insurance By Using These Effortless Reco

Student Health Insurance For Studying In Germany Guide

Student Health Insurance For Studying In Germany Guide

Checklist 7 Things To Do Before You Enroll In A Medicare Plan Healthpartners Medicare

Checklist 7 Things To Do Before You Enroll In A Medicare Plan Healthpartners Medicare

If I Didn T Enroll In A Plan By The Open Enrollment Deadline What Are My Options Healthinsurance Org

If I Didn T Enroll In A Plan By The Open Enrollment Deadline What Are My Options Healthinsurance Org

Health Insurance In Germany How It Works For Freelancers

Health Insurance In Germany How It Works For Freelancers

2018 Open Enrollment Is Almost Over Don T Miss The Dec 15 Deadline Healthcare Gov

2018 Open Enrollment Is Almost Over Don T Miss The Dec 15 Deadline Healthcare Gov

Clive Standen On Twitter We All Need To Be Covered With A Mask To Prevent Covid 19 And If You Don T Have Health Insurance You Need To Get Covered Now The Deadline To

Clive Standen On Twitter We All Need To Be Covered With A Mask To Prevent Covid 19 And If You Don T Have Health Insurance You Need To Get Covered Now The Deadline To

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.