Employers are encouraged to familiarize themselves with the changes in order to answer employees questions that may arise. If you Googled Should I claim 0 or 1 on W4 then read on.

Ca 2020 W 4 Form W4 Form 2021 Printable

Ca 2020 W 4 Form W4 Form 2021 Printable

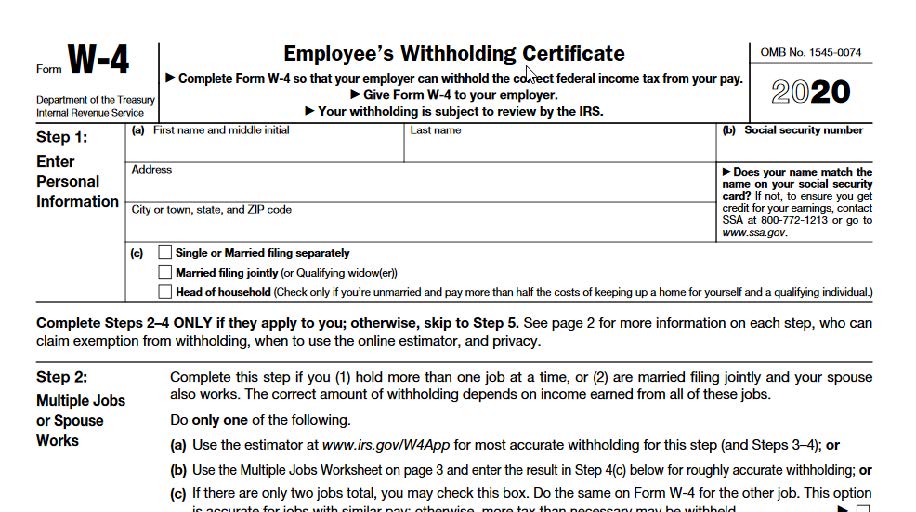

The W4 form printable is used to aid an employees withholding of tax funds as well as other kinds of payroll transactions.

W4 2020 california. W4 has one of the most extensive inventory of couplings valves fittings tapping sleeves and clamps anywhere with fast 247 customer support. December 2020 Department of the Treasury Internal Revenue Service. You will be asked to write down how many allowances you want on that particular form.

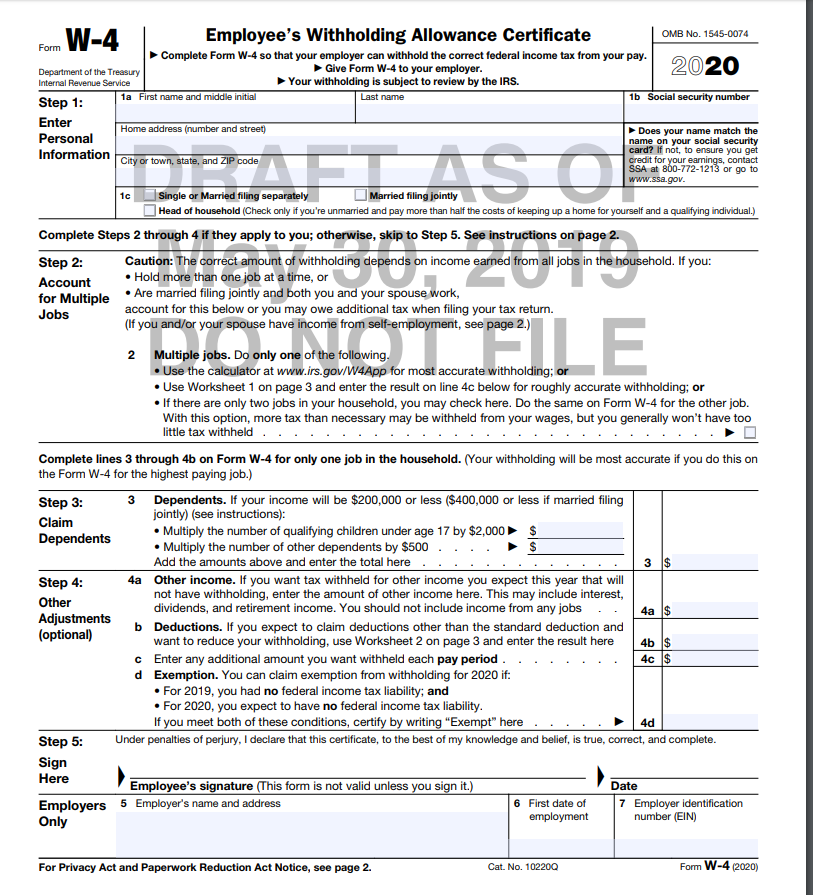

10 rânduri 2020 12162020 Form W-4 SP Employees Withholding Certificate Spanish version. California Withholding Calculator 2020 Withholding Calculator Find out how much California state tax will be withheld from your paycheck based on how you fill out your Form DE4. January 15 2020 2020-0096 California employees are now required to submit both a federal Form W-4 Employees Withholding Certificate and state Form DE 4 Employees Withholding Allowance Certificate when beginning new employment or changing their state withholding allowances.

For reference employees hired before 2020 arent required to complete a new W-4. Need to withhold less money from your paycheck for taxes increase the number of allowances you claim. Trong hướng dẫn chi tiết này chúng tôi sẽ thảo luận về mẫu W4 2020.

When you start a new job your employer will hand the W-4 to you. Chúng tôi sẽ chia sẻ thông tin chi tiết về hình thức lấy mẫu w4 2020 ở đâu mẫu mới của liên bang w4 từ mẫu w4 2019 cách tải xuống w4 mới mẫu 2020. Give Form W-4 to your employer.

Complete Steps 34b on Form W-4 for only ONE of these jobs. To make sure you withhold the right amount for the rest of the tax year you should provide the completed W-4 s to your employer s as soon as possible after completion. Employers will continue to compute withholding based on the information from the employees most recently submitted Form W-4.

W4 has a complete line of fittings that meets. An employee fills out that particular form to claim their allowances after they begin a new job. Therefore all newly hired employees and any existing employees that wish to change the number of California withholding allowances must.

Beginning in 2020 new hires must use the redesigned W-4 form. Ca 2020 W 4 Form As the usage of paper forms and papers continues to become a staple of business and industrial actions there is a necessity for businesses to create usage of the W4 form printable. Your withholding is subject to review by the IRS.

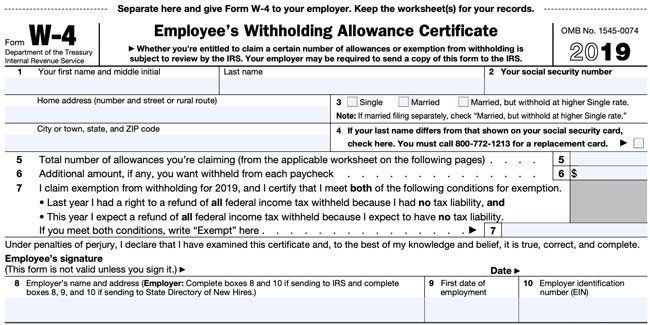

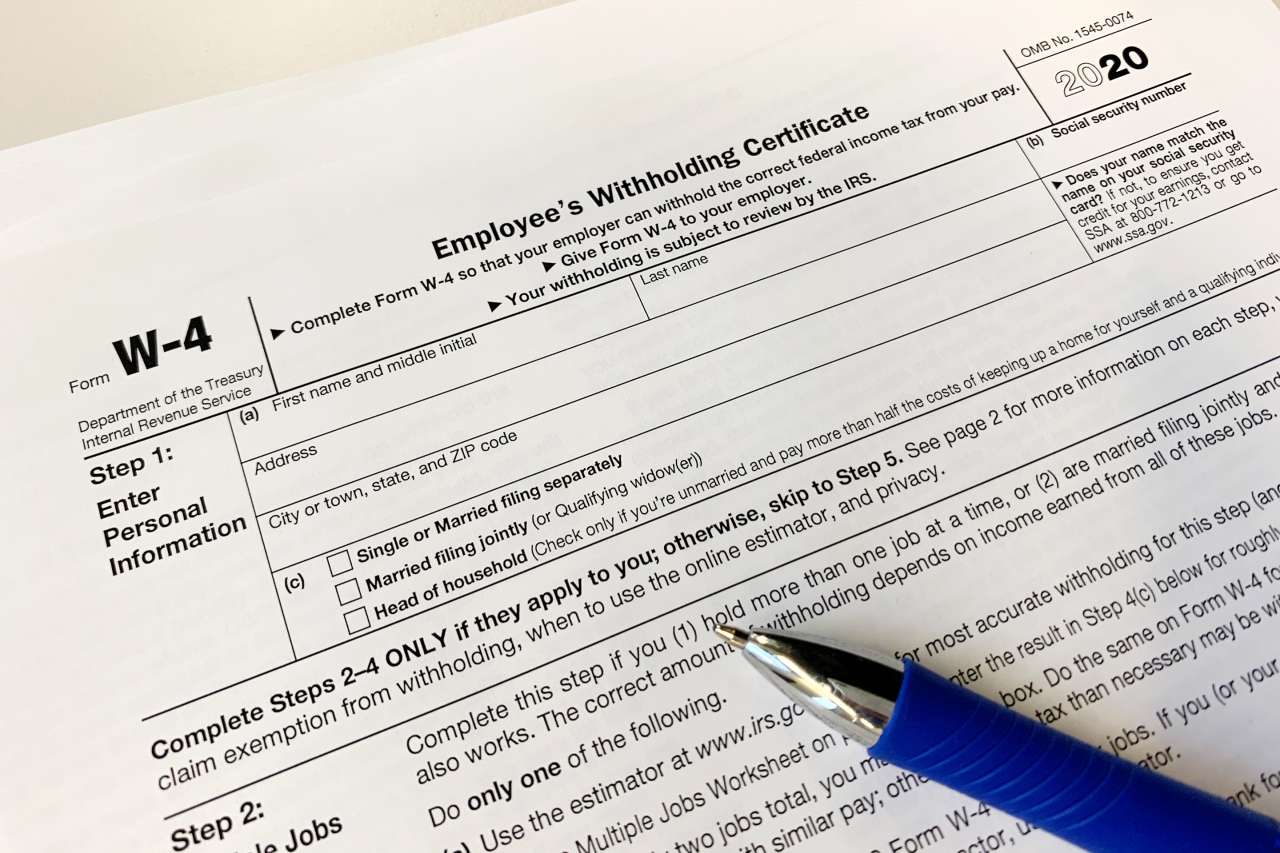

You must file the state form Employees Withholding Allowance Certificate DE 4 to determine the appropriate California Personal Income Tax PIT withholding. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheckThe form was redesigned for 2020 which is why it looks different if youve filled one out before then. If youre filling out a Form W-4 you probably just started a new job.

Beginning January 1 2020 Employees Withholding Allowance Certificate Form W-4 from the Internal Revenue Service IRS will be used for federal income tax withholding only. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content. Or maybe you recently got married or had a baby.

These changes mainly apply to anyone adjusting their withholdings and those who got a new job following Jan. Only need to adjust your state withholding allowance go to the Employment Development Department EDD website and get Form DE 4 Employees Withholding Allowance Certificate. The Internal Revenue IRS has changed the Form W-4 for the year 2020 and federal allowances have been removed.

Our W-4 calculator is forward looking meaning your W-4 Form updates apply to your future paycheck withholding. Since federal allowances have been removed the new Form W-4 cannot be used for California purposes. The worksheet is intended to let employers calculate the 2020 withholding amount using an employees previously completed Form W-4 or the newly designed form.

Finally the tax return you file in April 2021 will contain any adjustments youve made to your withholdings in 2020. To be accurate submit a 2020 Form W-4 for all other jobs. Current employees who submitted a W-4 form prior to 2020 are not required to submit a new form merely because of the redesign.

Leave those steps blank for the other jobs. Simplified income payroll sales and use tax information for you and your business. California Franchise Tax Board Certification date July 1 2019 Contact Accessible Technology Program.

The W-4 is an IRS form. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If you or your spouse have self-employment income including as an independent contractor use the estimator.

California W4 Fill Online Printable Fillable Blank Pdffiller

California W4 Fill Online Printable Fillable Blank Pdffiller

Tax Reform Redux Most Taxpayers Didn T Adjust Their Withholding Before 2020 Filing Season Cpa Practice Advisor

Tax Reform Redux Most Taxpayers Didn T Adjust Their Withholding Before 2020 Filing Season Cpa Practice Advisor

Everything You Need To Know About The New W 4 Tax Form Abc News

Everything You Need To Know About The New W 4 Tax Form Abc News

Https Www Irs Gov Pub Irs Pdf Fw4 Pdf

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Releases Draft 2020 W 4 Form

Irs Releases Draft 2020 W 4 Form

The Irs Has A New Easier W 4 For Withholding Taxes In 2020 Money

The Irs Has A New Easier W 4 For Withholding Taxes In 2020 Money

E Alert Irs Issues 2020 Form W 4 Hr Knowledge

E Alert Irs Issues 2020 Form W 4 Hr Knowledge

:max_bytes(150000):strip_icc()/Screenshot19-f74986306e004d1ca1a01e39b79a3cf1.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.