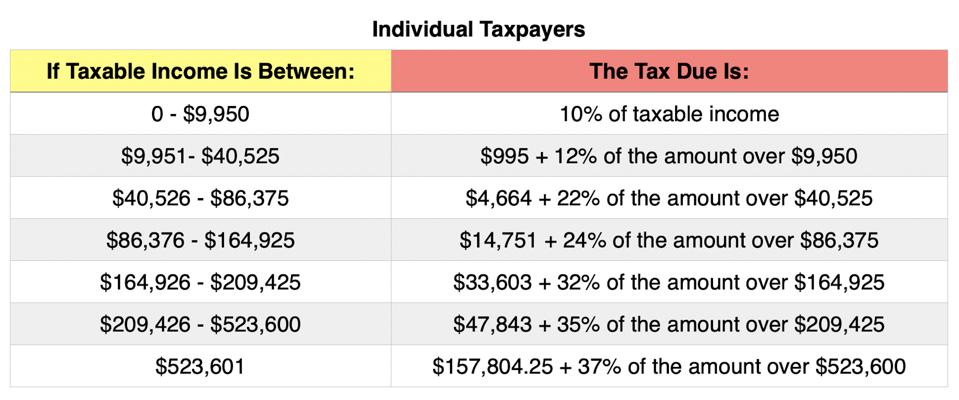

His core tax proposals will increase taxes on people earning more than 400000 per year and raise corporations tax rates from 21 to 28. If your taxable income is 51800.

Filing As Head Of Household What To Know Credit Karma Tax

Filing As Head Of Household What To Know Credit Karma Tax

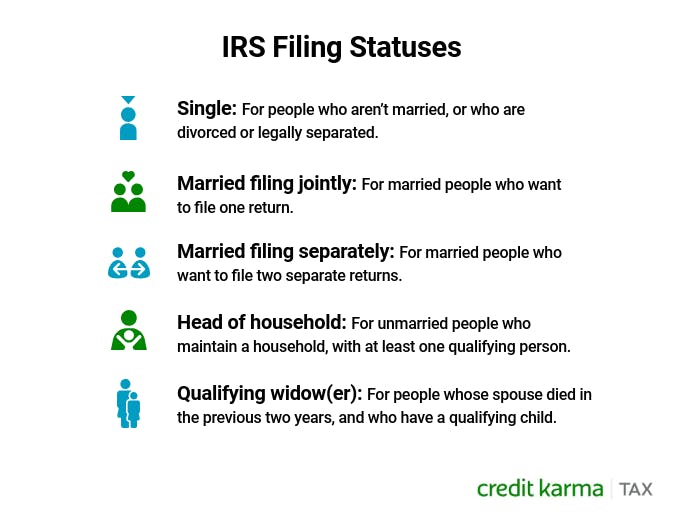

Single filers are allowed a standard deduction of 6300 for the 2015 tax year while head of household filers receives a 9250 deduction.

How much does head of household get back in taxes. The upshot of the new rules is that theres a maximum youll be able to save from the tax brackets using head of household status. For tax year 2019 taxpayers who use the head of household filing status may receive an 18350 annual standard deduction. Thats up 300 from 2019.

2020 Due Date. The IRS set the 2020 standard deduction for heads of household at 18650. Well the average tax refund is about 3046 per The Washington Post.

According to the Tax Foundation head of household filers could also pay less in their respective tax bracket. This means the taxable income of a head of household filer will automatically be 2950 less than that of a single filer. Head of household.

If youre able to file as head of household it could give your refund a significant boost. Ohio Head of Household Tax Brackets. Contrast this with single filers and married individuals who file separate returnsthey can claim only a 12400 standard deduction in 2020.

So how much are YOU going to get back in taxes in 2021. For tax purposes this could mean a child or a dependent adult including an aging parent. 1 It increases to 18800 for 2021 because standard deductions are indexed for inflation.

You enter in some quick basic info and it will calculate what your federal refund. And the numbers for tax year 2021. The standard deduction is 9350 for the 2017 tax year if you file as the head of a household.

The standard deduction for head-of-household filing status is 18650 for 2020 the tax return youll file in 2021. Its refundable so even if you paid in no federal tax you will get a refund. So expect around three grand for your tax refund.

In comparison a single filer is only entitled to a. But that amount will be reduced depending upon the AGI of the person claiming them on their taxes. For your 2020 taxes the standard.

You wont have to pay your stimulus check back to the. You should get close to the same amount as long as you file as head of household and claim the EIC earned income credit. The standard deduction for the head of household is 18350.

The Ohio Head of Household filing status tax brackets are shown in the table below. If you google tax refund calculator and pick the hrblock link there should be a nice little calculator. Filers using the single or married filing separately statuses have a standard deduction of 6350.

For single taxpayers and. Generally you need to have paid more than half the cost of maintaining a household for yourself and a qualifying dependent over the course of the year. For heads of household the standard deduction will be 18650.

The standard deduction for married couples filing jointly is 25100. The head of household standard deduction for 2020 is 18650 up from 18350 in 2019. The IRS looks at a lot of figures to calculate how much your qualify for including if your adjusted gross income or AGI is less than 80000 for single taxpayers 120000 as heads of.

These income tax brackets and rates apply to Ohio taxable income earned January 1 2020 through December 31 2020.

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

Who Can Claim Head Of Household On Taxes Rules And Penalty Toughnickel

How Much Could I Get Back In Taxes Tax Walls

How Much Could I Get Back In Taxes Tax Walls

Guide To Filing Taxes As Head Of Household H R Block

Guide To Filing Taxes As Head Of Household H R Block

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

What Are Marriage Penalties And Bonuses Tax Policy Center

What Are Marriage Penalties And Bonuses Tax Policy Center

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

/head-of-household-filing-status-3193039_final-e1ff704b38ee49bc83351f263f213ac4.png) How To File Your Taxes As Head Of Household

How To File Your Taxes As Head Of Household

/standard-deduction-3193021-HL-9ef8b7499d924df793cc368b688baa7a.png) Standard Tax Deduction What Is It

Standard Tax Deduction What Is It

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.