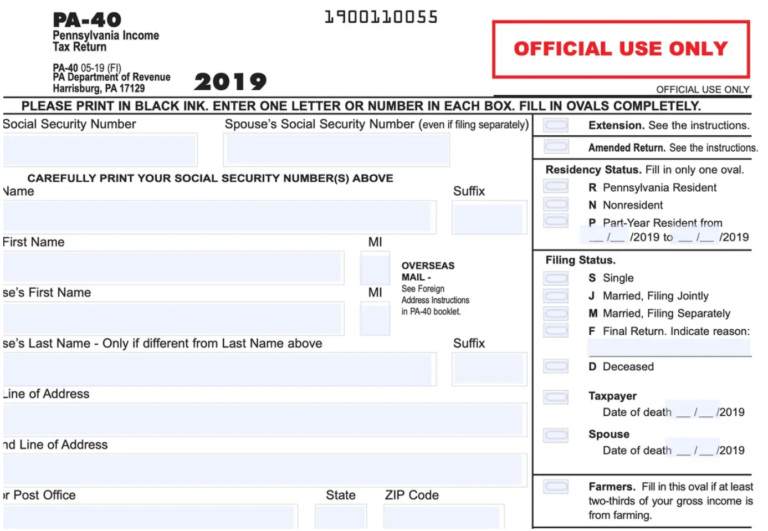

MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically. Additional delays may apply to filers with incomplete tax returns tax returns with errors or returns that require additional reviews.

Pennsylvania State Tax Refund Pa State Tax Brackets Taxact Blog

Pennsylvania State Tax Refund Pa State Tax Brackets Taxact Blog

This program offers a limited lookback period and.

Pennsylvania tax refund delays. Depending on how you file your state return you may need to wait a few days or several weeks before it shows up in the system. LEVITTOWN Pennsylvania WPVI -- A. The Department of Revenue e-Services has been retired and replaced by myPATH.

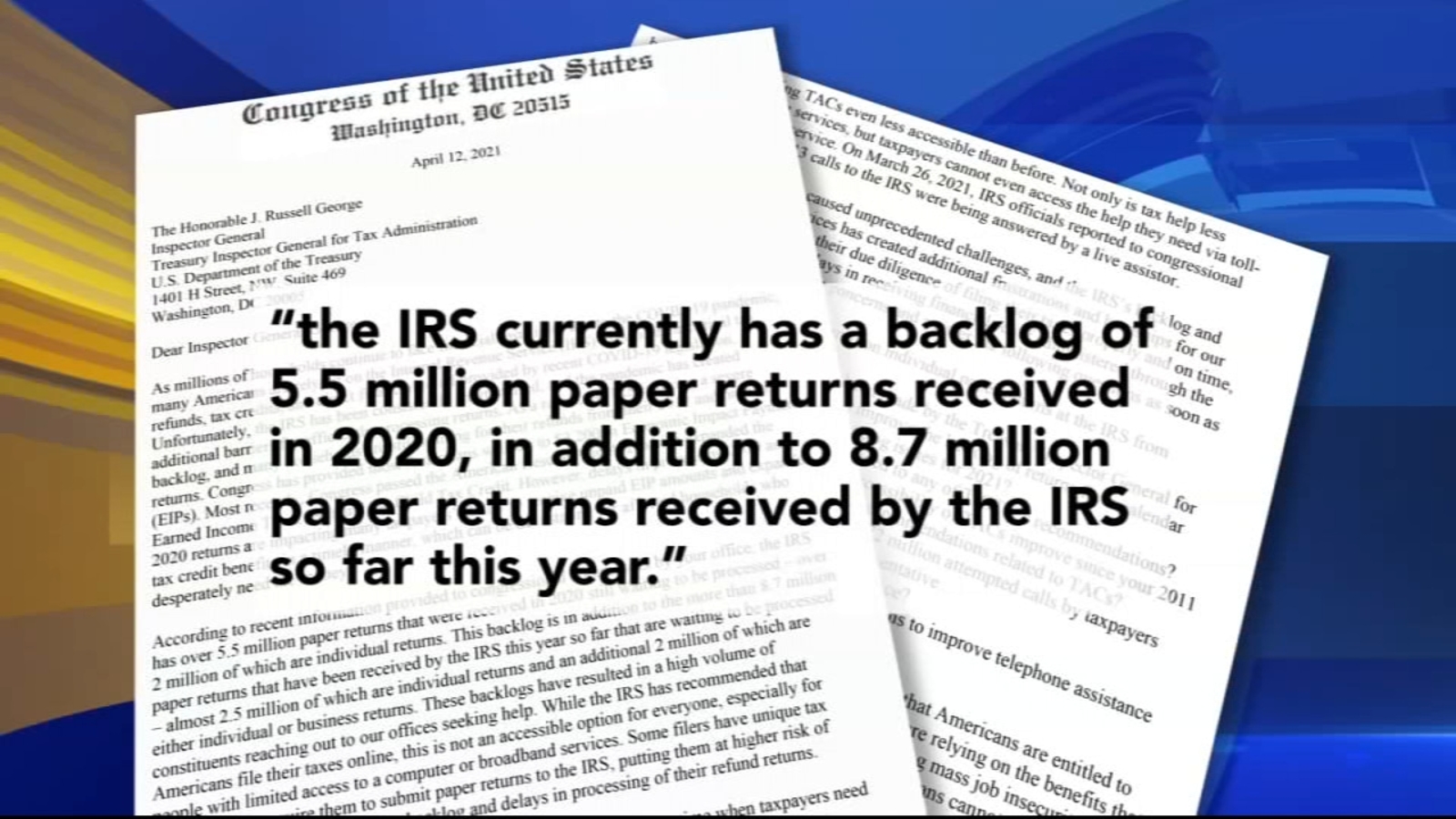

How long will it take to get my Pennsylvania tax refund. IRS experiencing major backlog delays on tax refunds. With the new tax deadline approaching next week they want to know when they can expect their money.

The 90-day delay announced by the Pennsylvania Department of Revenue keeps Pennsylvania in line with the federal government which announced the same delay on Friday. And while members praised the agency head for extending the April 15 tax filing deadline by a month to May 17 Rettig was reminded repeatedly by lawmakers that the. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2019 Pennsylvania personal income tax returns is extended to July 15 2020.

If you have math errors on your tax return or have other adjustments. After your overpayment is processed it normally takes an additional 3 to 4 weeks for your refund to be mailed or direct deposited. The Pennsylvania Department of Revenue announced Thursday that the deadline for state taxes has been moved to May 17 2021.

The Department of Revenue. And while members praised the agency head for extending the April 15 tax filing deadline by a month to May 17 Rettig was reminded repeatedly by lawmakers that the refunds are a lifeline for some. There are a number of reasons why your Pennsylvania state refund may be delayed including the following.

The Internal Revenue Service. However if the department needs to verify information reported on your return or request additional information the process will take longer. Pennsylvania is delaying the deadline to file state income taxes.

Statement from the Department of Revenue. The Internal Revenue Service will begin refunding money to people in May who already filed their returns without claiming the new tax break on unemployment benefits the agency said Wednesday. If you filed electronically it takes approximately 4 weeks to process your tax return.

Reason for Tax Refund Delay. You Claim Certain Credits If you file on the early side and claim the earned income tax credit EITC or the additional child tax credit ACTC you will have to wait a bit for a refund. This means taxpayers will have an additional 90 days to file from the original deadline of April 15.

The Department of Revenue is offering a 90-day Voluntary Compliance Program for any business that has inventory or stores property in Pennsylvania but is not registered to collect and pay Pennsylvania taxes. The IRS still plans to issue 9 out of 10 returns within 21 days but some returns could take longer. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021 03182021 Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020.

If the department needs to verify information reported on your return or request. Additional information the process will take longer. If you file electronically it typically takes one to three business days but if you file a paper return you may not be able to track it until eight to 10 weeks after you submit it.

A major backlog at the IRS is affecting when people receive their refunds. HARRISBURG With the coronavirus outbreak leading to layoffs business closures and a record spike in unemployment claims Pennsylvania has delayed the deadline for filing personal income tax returns offering taxpayers much-needed relief. For electronic filers 2 weeks or less.

Tax returns filed by paper are expected to take longer than usual up to 7 weeks up from the normal 4-6 weeks. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021 March 18 2021 Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and.

Pennsylvania Follows Irs Delays Tax Deadline To May 17

Pennsylvania Follows Irs Delays Tax Deadline To May 17

Where S My Refund Pennsylvania H R Block

Where S My Refund Pennsylvania H R Block

Irs Tax Refunds Are Delayed By Weeks This Year

Irs Tax Refunds Are Delayed By Weeks This Year

Irs Experiencing Major Backlog Delays On Tax Refunds 6abc Philadelphia

Irs Experiencing Major Backlog Delays On Tax Refunds 6abc Philadelphia

Average Irs And State Tax Refund And Processing Times 2020 To 2021 Tax Season Aving To Invest

Average Irs And State Tax Refund And Processing Times 2020 To 2021 Tax Season Aving To Invest

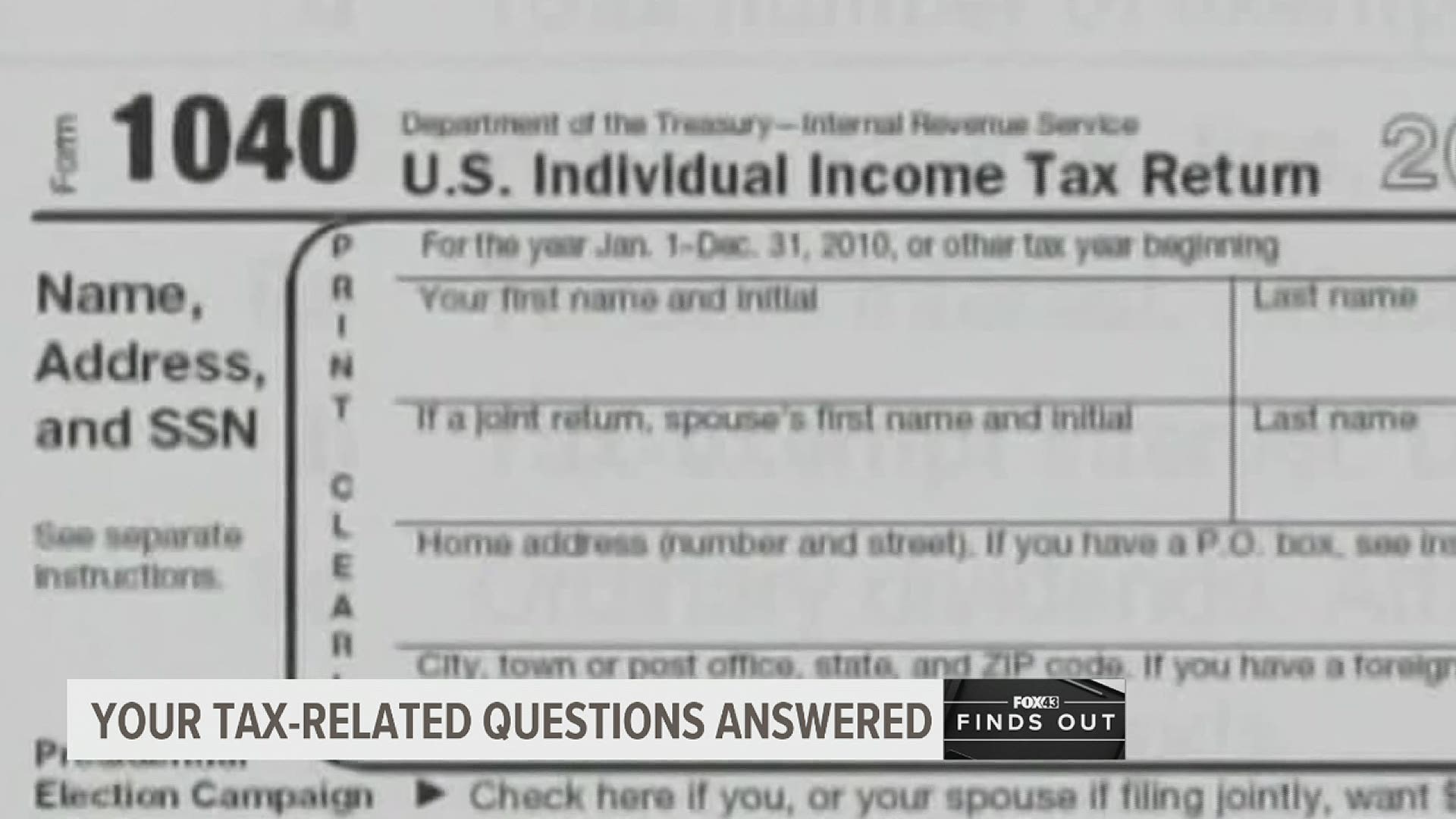

Pennsylvania Department Of Revenue Announces 1 Month Extension To File 2020 Income Tax Returns Fox43 Com

Pennsylvania Department Of Revenue Announces 1 Month Extension To File 2020 Income Tax Returns Fox43 Com

Delay Of Tax Deadline Due To The Coronavirus Will Cause Significant Disruption To Pa S Budget Process

Delay Of Tax Deadline Due To The Coronavirus Will Cause Significant Disruption To Pa S Budget Process

![]() Will My Pa Tax Refund 2020 Come Sooner

Will My Pa Tax Refund 2020 Come Sooner

Was The Tax Year 2019 Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog

Was The Tax Year 2019 Tax Deadline Delayed What To Know About Coronavirus Covid 19 And Your Taxes The Turbotax Blog

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

Pennsylvania Delays State Income Tax Deadline To May 17

Pennsylvania Delays State Income Tax Deadline To May 17

Don T Waste Your Money Tax Refund Delay Abc27

Don T Waste Your Money Tax Refund Delay Abc27

/WhereIsYourTaxRefund-85e9107ea88049bab6caf00d2d62dc71.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.