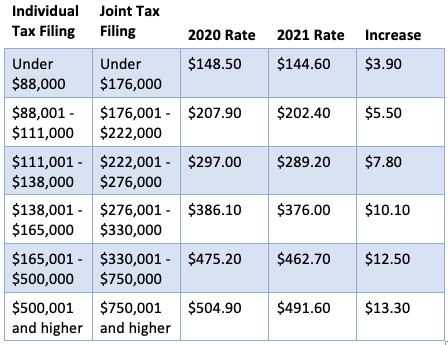

The standard monthly premium is scheduled to rise to 14460 next year. The national base beneficiary premium amount for Medicare Part D in 2021 is 3306 but costs vary.

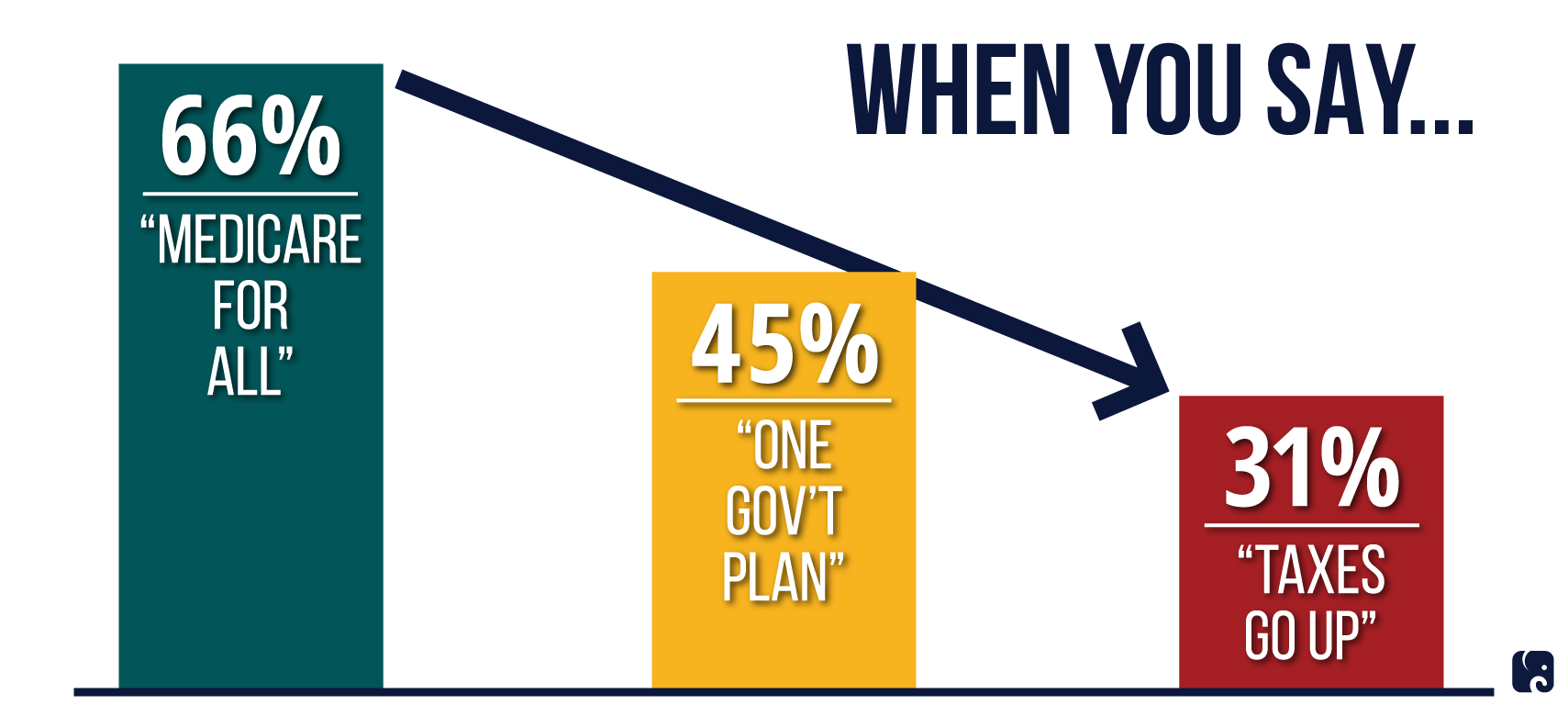

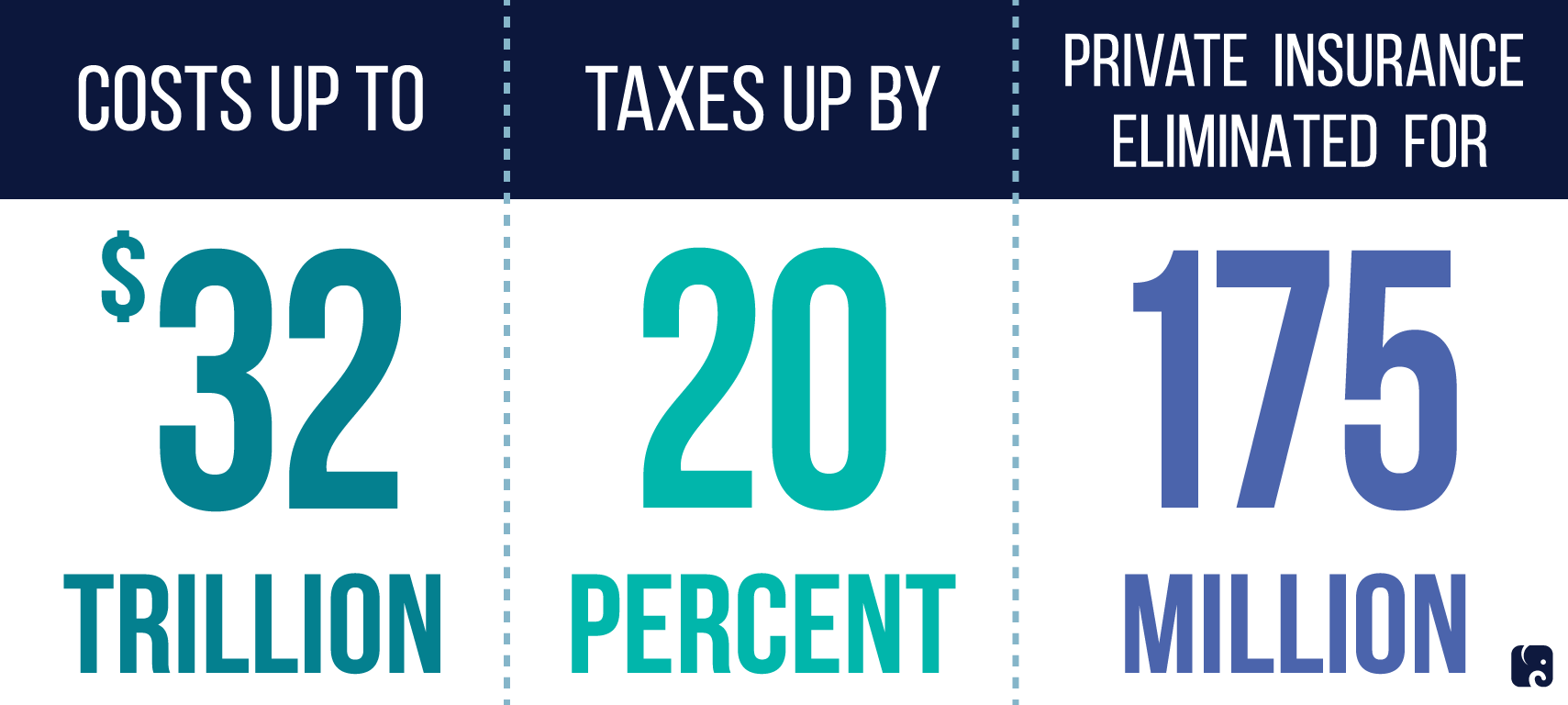

Medicare For All Higher Taxes Fewer Choices Longer Lines

Medicare For All Higher Taxes Fewer Choices Longer Lines

That is a 910 increase from last years 13550 standard premium.

How much is medicare going up. How much Medicare Part B medical insurance costs including Income Related Monthly Adjustment Amount IRMAA and late enrollment penalty. To understand the percentage paid you need to first understand the three types of federal spending. You can read about prescription drug coverage here and whether youve hit the Medicare Part D coverage gap or donut hole.

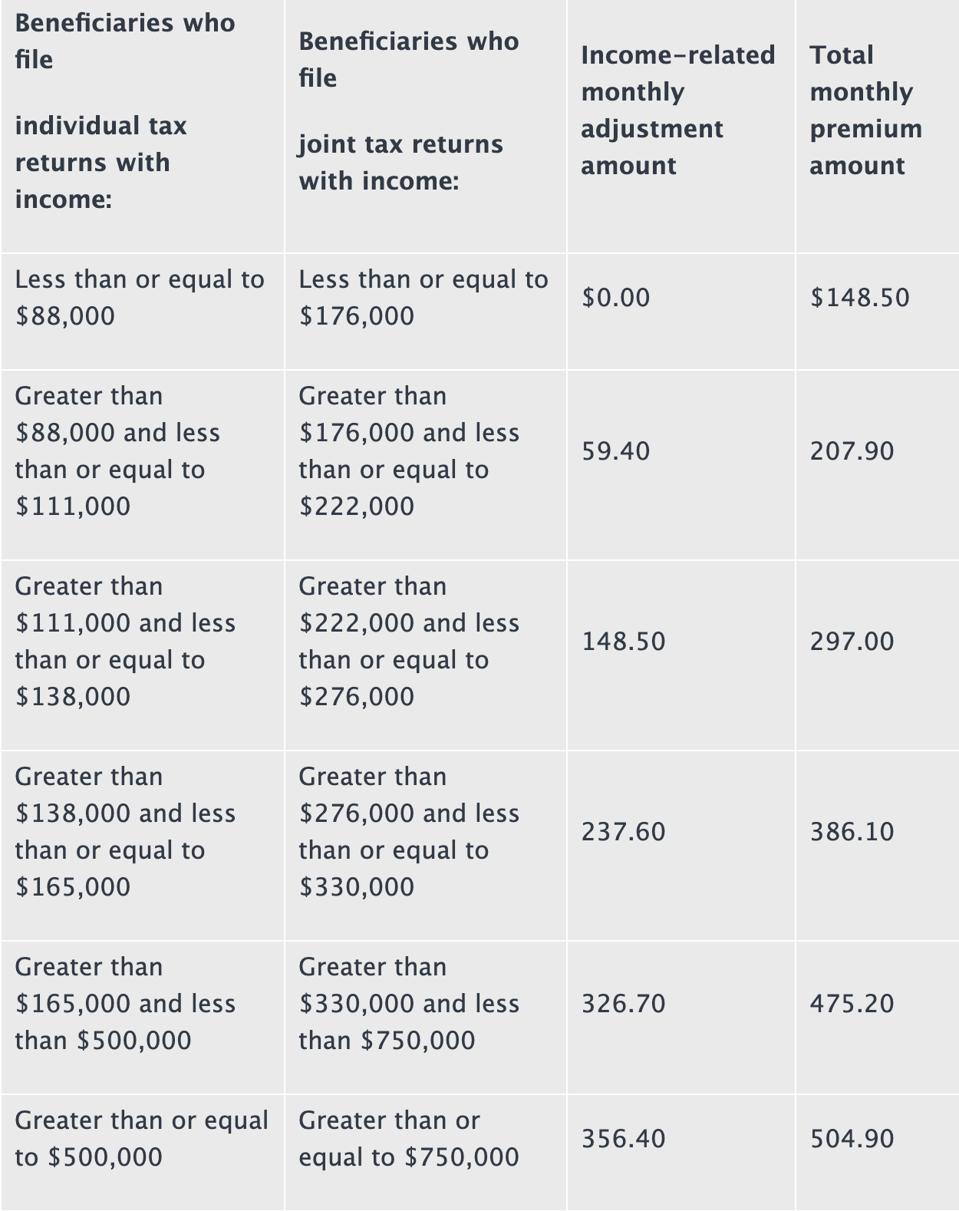

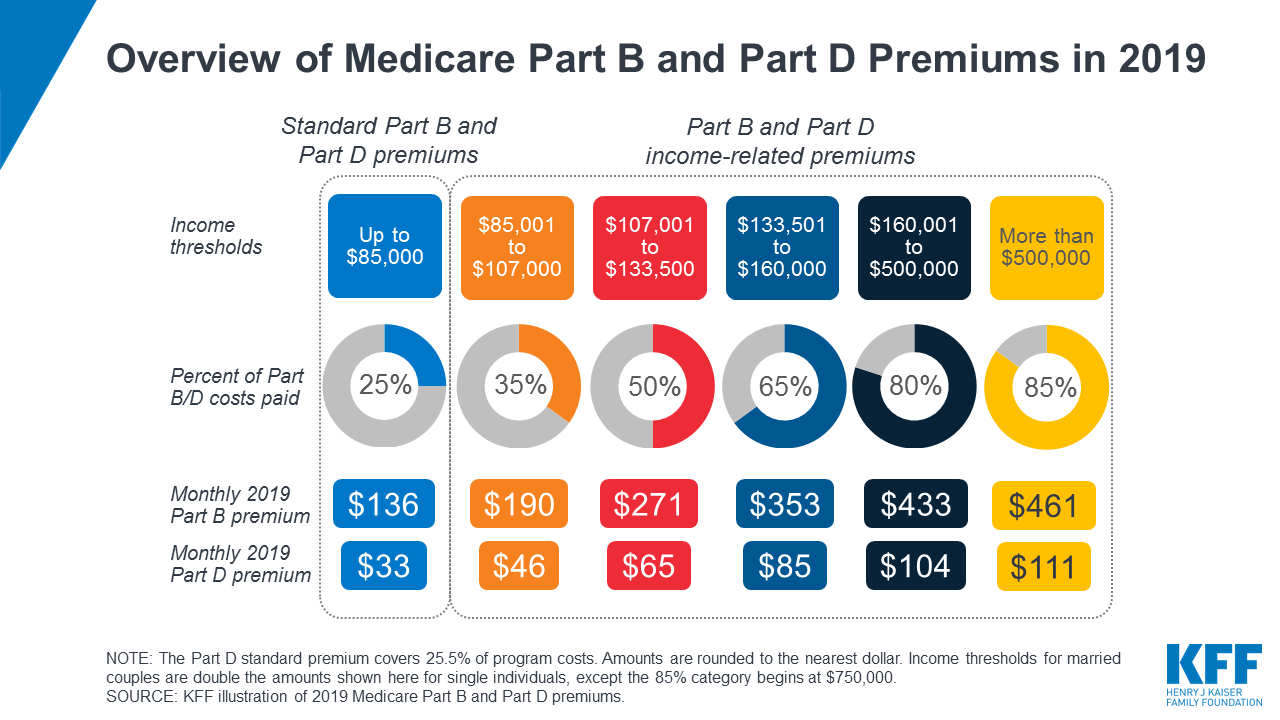

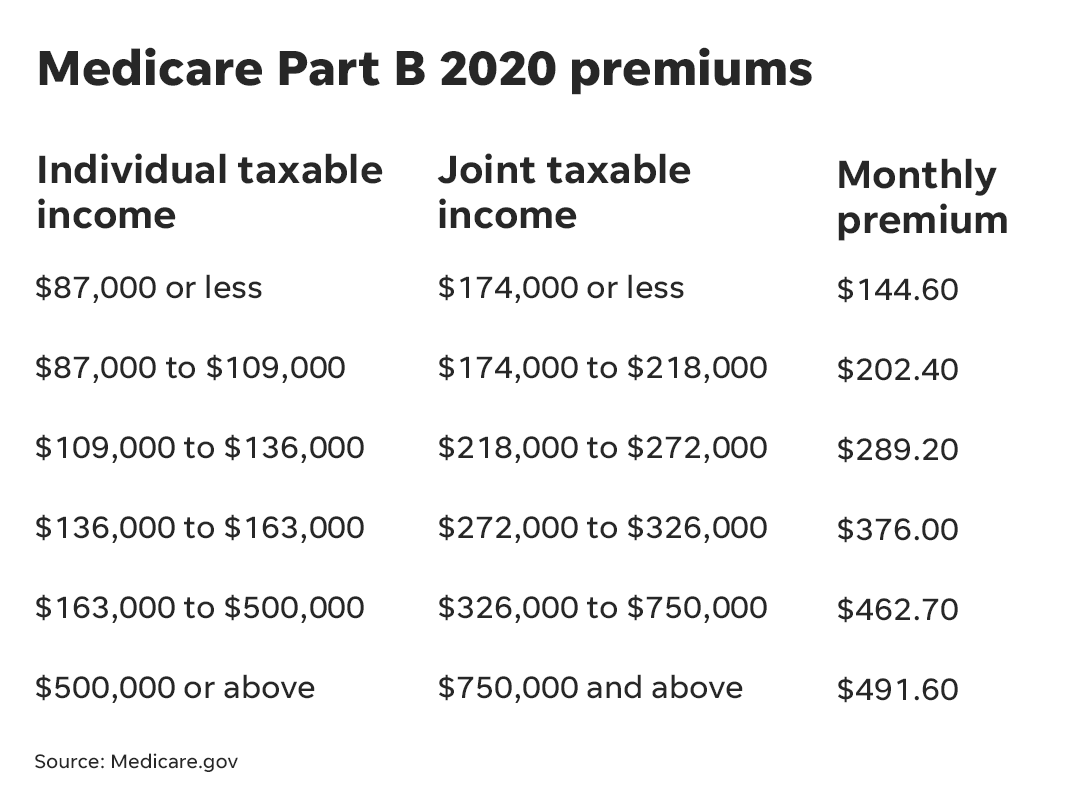

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan Part C. At higher incomes premiums rise to a maximum of 50490 a month if your MAGI exceeded 500000 for an individual 750000 for a couple. If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471.

Copays and coinsurance vary by plan and tier some drugs cost more than others. This is an increase of 910 compared to 2019 when premiums were 13550. A low-spending scenario where healthcare spending is still low and translates to a 4 medical cost trend A medium-spending scenario where costs grow at the same rate in 2021 as it did from 2014 to.

The income brackets for high-income premium adjustments for Medicare Part B and D will start at 88000 for a single person and the high-income surcharges for Part D and Part B will increase in 2021. This monthly premium tends to go up a little bit each year. If you end up spending more than 60 days in the.

If your MAGI for 2019 was less than or equal to the higher-income threshold 88000 for an individual taxpayer 176000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2021 which is 14850 a month. Medicare Hospital Stays Costs If you are hospitalized Medicare Part A has a 1408 deductible. The deductibles vary but no Medicare Part D plan can have a deductible higher than 445 in 2021 up from 435 in 2020.

Most people pay the standard premium amount of 14460 as of 2020 because their individual income is less than 8700000 or their joint income is less than 17400000 per year. If you buy Part A youll pay up to 471 each month in 2021. While my retirement income did not change my monthly premium is now 349.

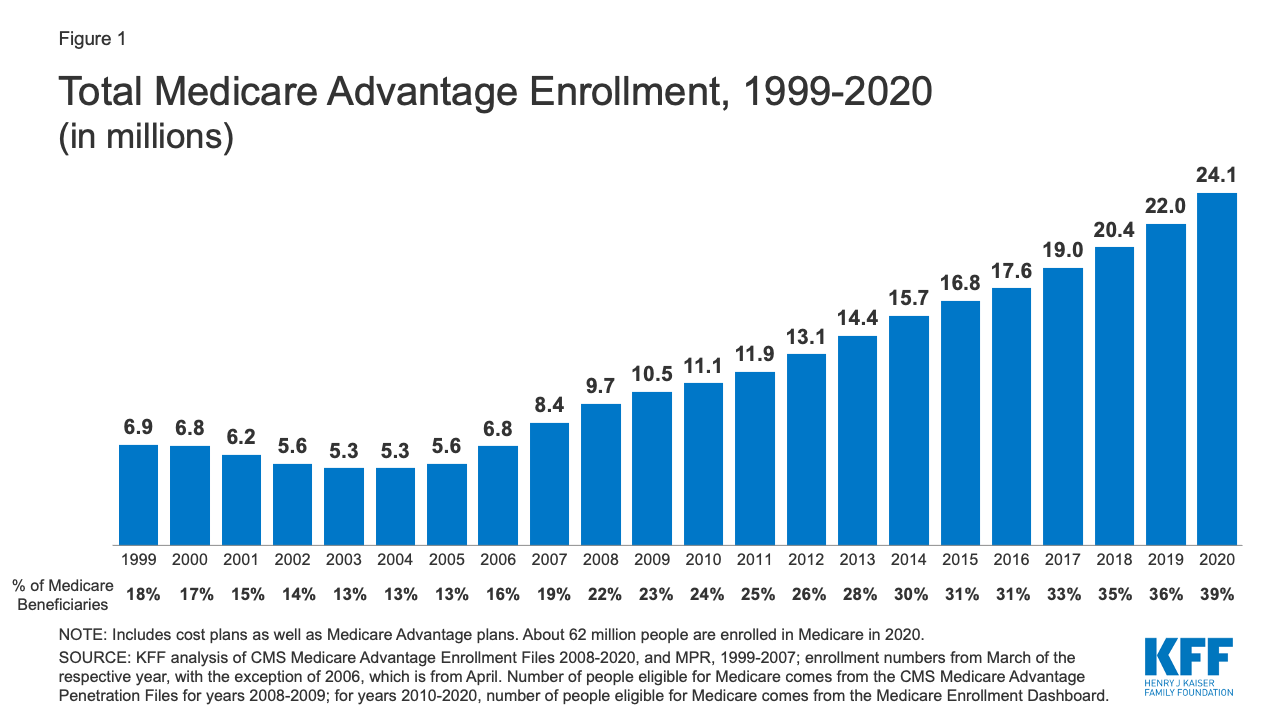

Congress saw fit to increase monthly Medicare premiums in 2018. This means its important to make sure you really need Medicare Part B because if you dont youre paying for insurance you arent using. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million.

Based on reporting from the Centers for Medicare Medicaid Services CMS the projected 2022 Medicare Part B premium is 15770 per month. Also if you have a high income your premium will be higher. The 910 monthly increase follows a smaller 150 rise this year.

That 910 dollar rise means youll be spending around 10920 more in 2020 to have Medicare which may not seem like much to some but can be the difference between having healthcare and not for others. Medicare Part B does have a monthly premium which is 14850 per month. Your Part D Premium will depend on the plan.

Beneficiaries also need Part B if they have retiree or COBRA coverage after age 65. 1 Its important to note that this figure only represents an estimate of 2022 Part B premiums. In 2021 the premium will be.

Deductibles for Medicare Part B benefits are 19800 as of 2020 and you pay this once a year. For about 70 of Medicare beneficiaries the premiums will rise nearly 7 to 14460 a month up from 13550 in 2019. In 2020 however that number is increasing to 14460.

Costs for Medicare health plans. Higher premiums are charged to those with incomes above 87000 for single filers or. Although the exact amount varies each year the government allocates a certain percentage of its annual budget to the Medicare program.

How Medicare Part B is changing Currently the standard monthly premium for Medicare Part B is 13550. If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259. Enrollment is a requirement for getting a Medicare Advantage plan or Medigap policy.

How Much Does the Government Pay for Medicare Each Year. Mandatory spending equals around 6463 of all yearly government spending. I also am enrolled in another health.

Medicare B Costs For Clients Projected To Rise Financial Planning

Medicare B Costs For Clients Projected To Rise Financial Planning

Medicare Part B Premiums To Rise 2 7 In 2021 With Premiums For Highest Income Couples Topping 12 000 A Year

Medicare Part B Premiums To Rise 2 7 In 2021 With Premiums For Highest Income Couples Topping 12 000 A Year

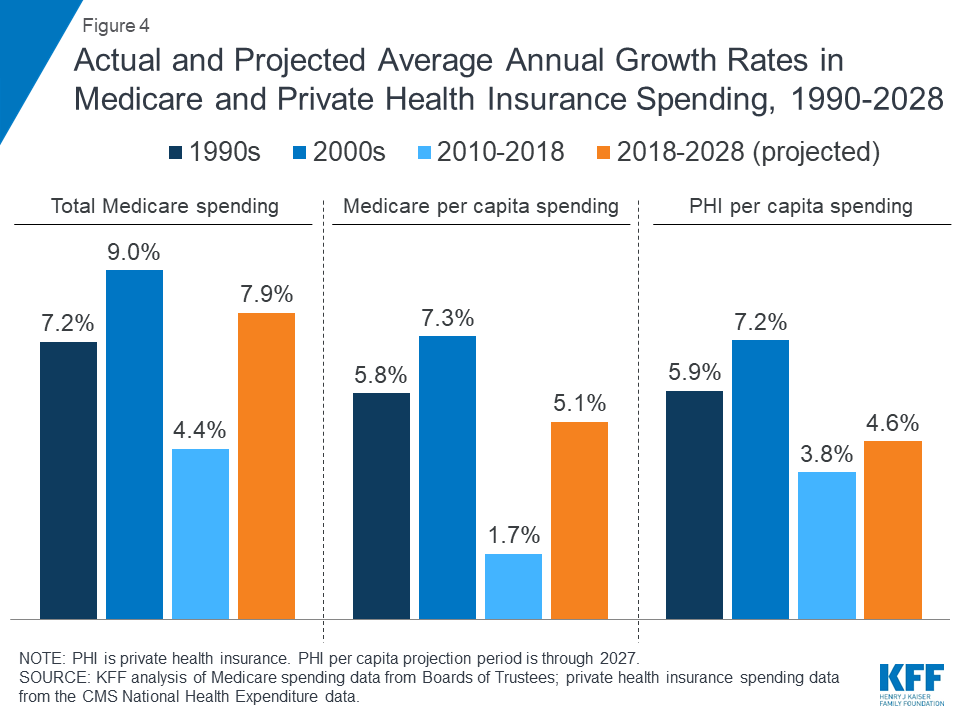

The Facts On Medicare Spending And Financing Kff

The Facts On Medicare Spending And Financing Kff

A Dozen Facts About Medicare Advantage In 2020 Kff

A Dozen Facts About Medicare Advantage In 2020 Kff

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

Medicare S Income Related Premiums Under Current Law And Changes For 2019 Kff

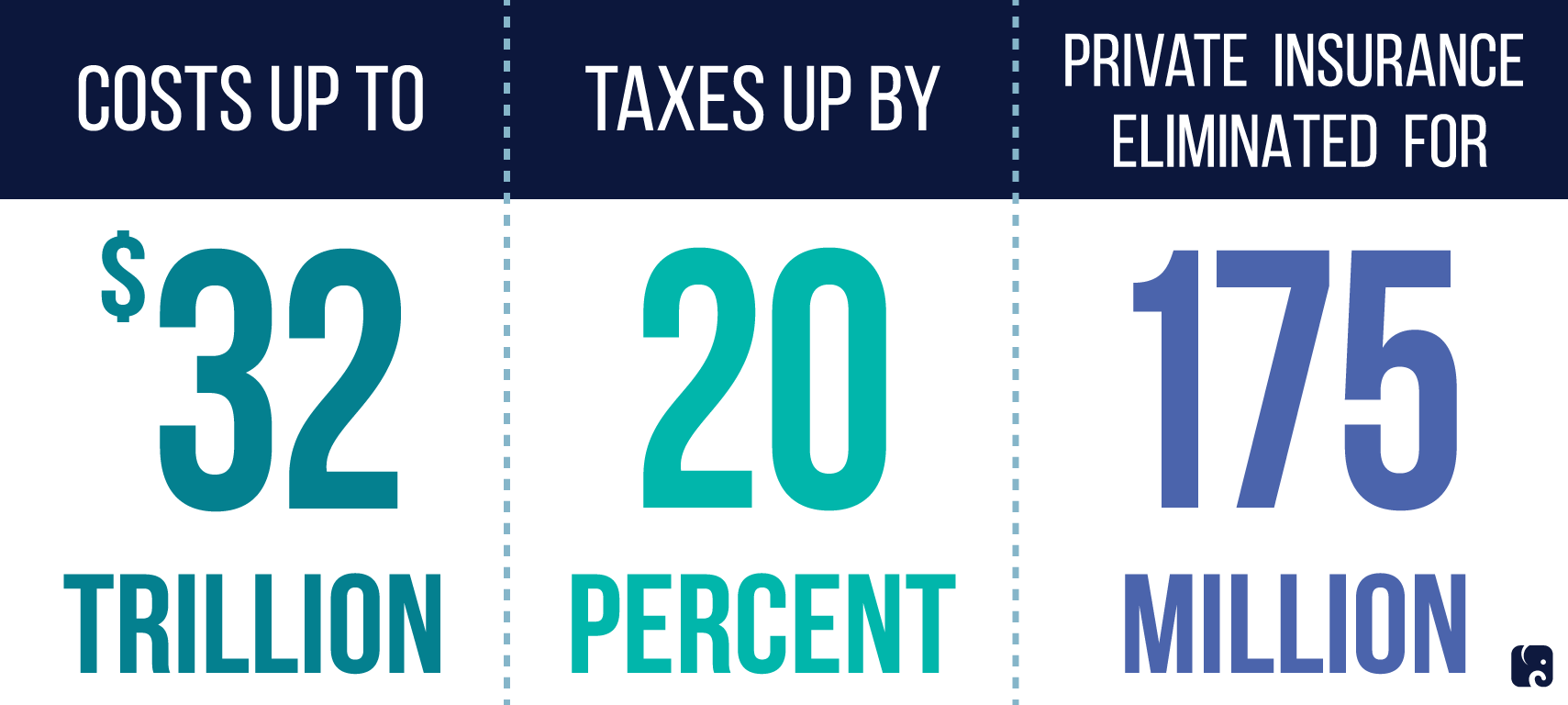

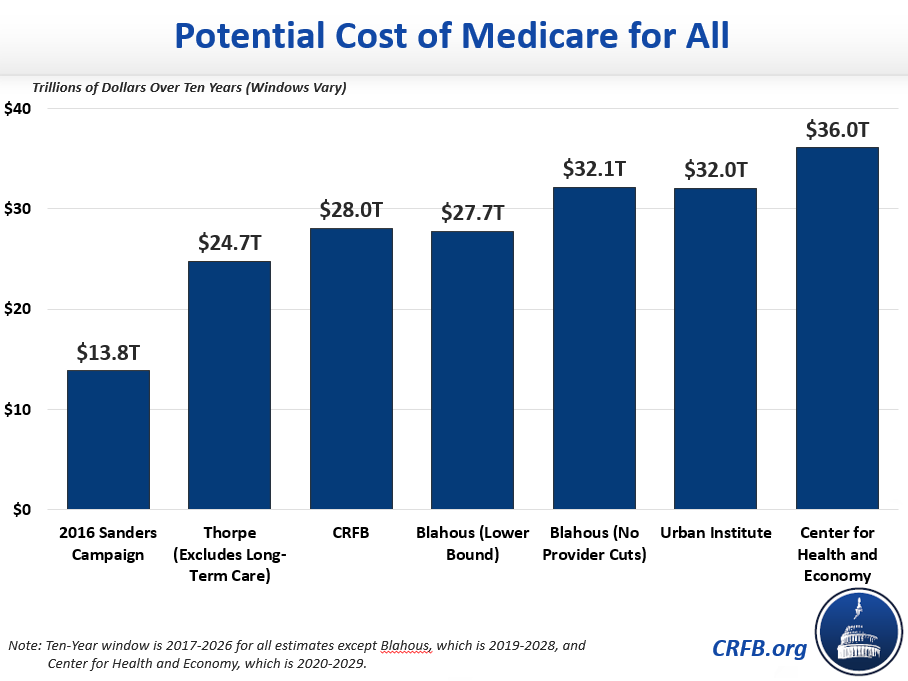

How Much Will Medicare For All Cost Committee For A Responsible Federal Budget

How Much Will Medicare For All Cost Committee For A Responsible Federal Budget

Information To Help You Age Well

Information To Help You Age Well

Medicare For All Higher Taxes Fewer Choices Longer Lines

Medicare For All Higher Taxes Fewer Choices Longer Lines

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

How Much Does Medicare Cost In 2020 And Beyond

How Much Does Medicare Cost In 2020 And Beyond

Medicare Part B 2020 Deductibles Premiums Increasing

Medicare Part B 2020 Deductibles Premiums Increasing

A Foolish Take A Big Jump In Medicare Costs Is Coming In 2020 The Motley Fool

A Foolish Take A Big Jump In Medicare Costs Is Coming In 2020 The Motley Fool

How Is Medicare Changing In 2021

How Is Medicare Changing In 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.