If you take a lump sum youll lose a total of 132 million upfront plus another 71 million from additional federal taxes for a total of 3469 million after just federal taxes alone. Probably much less than you think.

Lotto After Taxes Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Lotto After Taxes Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Are lottery winnings paid in instalments income.

How much after taxes lottery. How much money can you keep after taxes if you hit the jackpot on a lottery game like Powerball or Mega Millions. Up to an additional 13 could be withheld in state and local taxes depending on where you live. History would be as much as 589 million which could buy one of 20 teams in the National Hockey League.

Lets say you win a 1 million jackpot. Non-Arizona residents typically pay 6 state tax. If you win the jackpot you are highly likely to move into the top federal tax rate and your prize will be subject to a 37 percent withholding whether you select the cash lump sum or.

Click to see full answer Accordingly what percentage of taxes are taken out of lottery winnings. The federal taxes come around 24 which would fetch you about. State and local tax rates vary by location.

Even if your lottery winnings dont boost your tax bracket if the federal government withheld too much tax on your lottery winnings you might get a refund at tax time. The calculations are based on an 865 million annuity or a 6388 million lump sum. An after-tax calculator is available at USA Megas jackpot analysis page.

Yes all lottery winnings in Illinois are subject to tax. State tax rates on lottery winnings vary. That means after taxes the winner of the largest jackpot in US.

Depending on the number of your winnings your federal tax rate could be as high as 37 percent as per the lottery tax calculation. 51 rânduri Taxes on Lottery Winnings. 272 rânduri After 30 payments.

So for the games top prize of 1000 a day for life you would receive an annual payment after. How much would you get a week after taxes for 1000 a day for life. Read on for more about how taxes on lottery winnings work and what the smart money.

So the best first step lottery winners can take is to hire a financial advisor who can help with tax and investment strategies. So when you take the cash option you will end up with 284669928 after federal taxes. For example if you live and win in New York City the state.

So if you really want to be a Mega Millions winner then this is the cheapest easiest way to achieve your goal. 267 rânduri After 30 payments. State and local tax.

Each state has its own rules on taxing lottery winnings so check both your states tax website and your citys tax website for information. Do lottery winnings affect Social Security. To start everyone will lose 24 via.

Now it is the states turn. If you live in North Dakota your. But even after the appropriate taxes are withheld the remaining lottery winnings may still be vulnerable to IRS collections.

Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the statecity you. Yet the tax withholding rate on lottery winnings is only 24. State and Federal Tax If you win a prize of more than 5000 there will be an initial 24 percent withholding for federal tax.

On prizes worth 5000 or over 25 Federal Tax is required and all winnings above 1000 are subject to 5 State Tax. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. Some states dont impose an income tax while others withhold over 15 percent.

The reality is that you will end up with far less than 3million. Given that big spread some lottery winners do not plan ahead and can have trouble. If you take the lump sum today your total federal income taxes are estimated at 370000 figuring a tax bracket of 37.

Of course when you win 3million the federal government will want to take a bite of that big Mega Millions payout. This tool helps you calculate the exact amount. Still youll probably owe more when taxes are due since the top federal tax rate is 37.

Dear Powerball Winner Take Our Advice And Take The Annuity The New York Times

Dear Powerball Winner Take Our Advice And Take The Annuity The New York Times

Lottery Payout Tax Calculator All Information You Need To Know

Lottery Payout Tax Calculator All Information You Need To Know

How Much Tax Will Pay On Winning A Rs 1 Crore Lottery In India Quora

How Much Money Will You Get After Taxes If You Win The Mega Millions Jackpot Kiro 7 News Seattle

How Much Money Will You Get After Taxes If You Win The Mega Millions Jackpot Kiro 7 News Seattle

Winning 1 6b Mega Millions And 620m Powerball Jackpots Here S How Much You Ll Pay In Taxes

Winning 1 6b Mega Millions And 620m Powerball Jackpots Here S How Much You Ll Pay In Taxes

Lottery Taxes The Triple Tax Effect Ellsworth Associates Cpas Accountants In Cincinnati

Lotto After Taxes Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Lotto After Taxes Cheaper Than Retail Price Buy Clothing Accessories And Lifestyle Products For Women Men

Powerball How Much After Taxes Powerball

Powerball How Much After Taxes Powerball

768m Wisconsin Powerball Winner Pretty Much Felt Lucky Mpr News

768m Wisconsin Powerball Winner Pretty Much Felt Lucky Mpr News

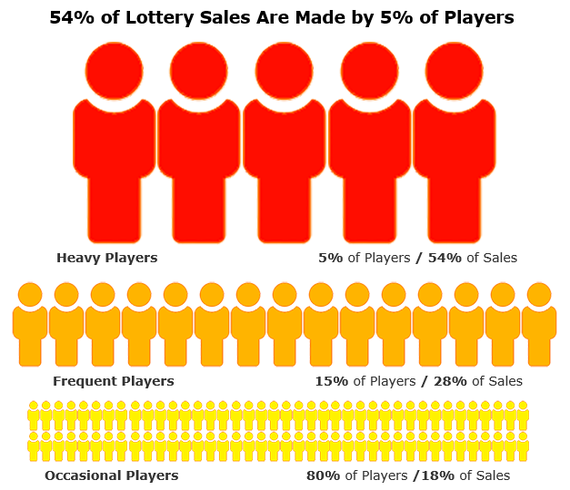

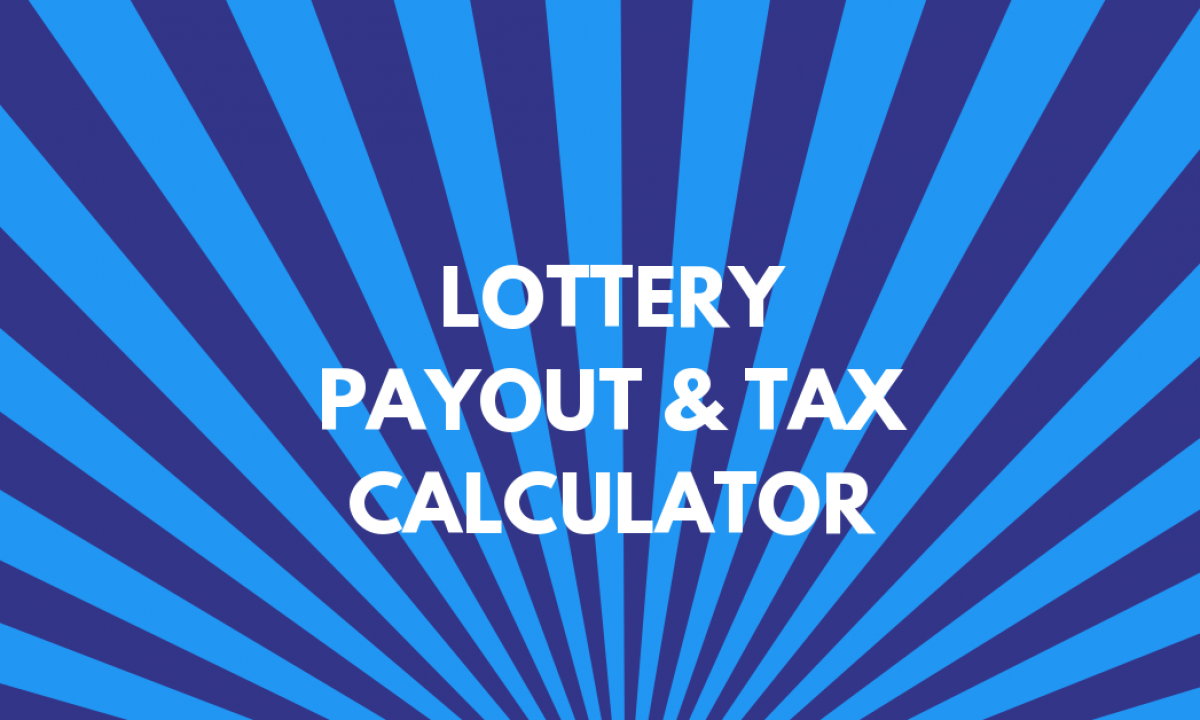

If You Play Every Combination Of Numbers For Tonight S Mega Millions Lottery And You Don T Split The Jackpot You Will Net 71 Mil After Taxes You Also Have 0 41 Ev With Every

If You Play Every Combination Of Numbers For Tonight S Mega Millions Lottery And You Don T Split The Jackpot You Will Net 71 Mil After Taxes You Also Have 0 41 Ev With Every

1 6 Billion Lottery Winner Will Face Huge Taxes Possible Lawsuits

1 6 Billion Lottery Winner Will Face Huge Taxes Possible Lawsuits

How Much Tax Would A Massachusetts Resident Owe On A 1 5 Billion Powerball Jackpot Masslive Com

How Much Tax Would A Massachusetts Resident Owe On A 1 5 Billion Powerball Jackpot Masslive Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.