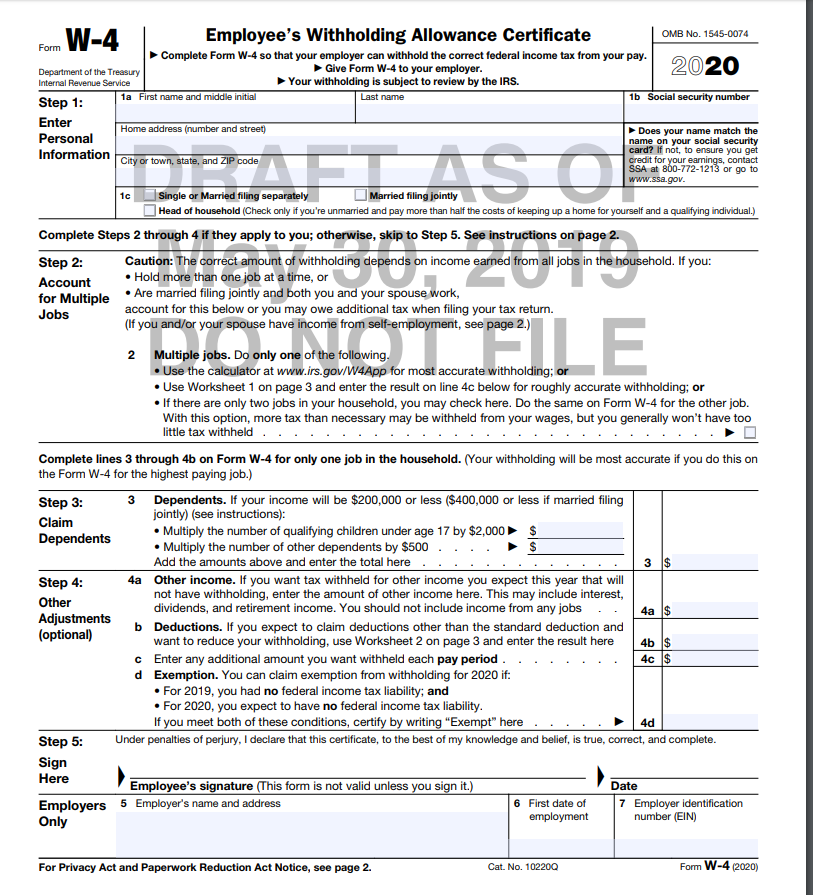

Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Pdf 2020 W 4 Form Because the usage of paper forms and papers carries on to become a staple of business and industrial routines there is a necessity for businesses to produce use of the W4 form printable.

Irs Overhauls Form W 4 For 2020 Employee Withholding

Irs Overhauls Form W 4 For 2020 Employee Withholding

The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

2020 w 4 forms. The biggest change is that it. This step needs to be completed only if the employee has more than one job at a. Enter Personal Information a.

Form W-4 2020 Married Filing Jointly. 2020 W-4 Calculator Form Changes Get the refund you want or have more money now. They are not required to furnish a new Form W-4 and if they do not furnish a new Form W-4 withholding will continue based on a valid form previously furnished.

Form W-4 changes for 2020. Instead using the new Form W-4 employees provide employers with amounts to increase or decrease the amount of taxes withheld and amounts to increase or decrease the amount of wage income subject to income tax withholding. Your withholding is subject to review by the IRS.

Give Form W-4 to your employer. 2020 W4 Printable Form As the usage of paper forms and papers proceeds to become a staple of business and commercial activities there is certainly a necessity for companies to produce utilization of the W4 form printable. The W4 form printable is used to aid an employees withholding of.

In 2020 the IRS released a new Form W-4 for 2020 with two key changes. The W4 form printable is used to facilitate an employees withholding of tax funds too as other types of payroll transactions. Designed to improve the accuracy of employee withholding amounts.

Employers engaged in a trade or business who pay compensation Form 9465. Use our W-4 calculator to help you adjust your IRS withholdings so you get the refund you want at tax time or more money in your pocket now. Employees Withholding Certificate Form 941.

You are not permitted to treat employees as failing to furnish Forms W-4 if they dont furnish a new Form W-4. 10 Zeilen Form W-4. 2020 Form W-4 New Design Primary goals to provide simplicity accuracy and privacy for employees while minimizing burden for employers and payroll processors.

The W4 form printable is used to facilitate an employees withholding of tax funds also as other kinds of payroll transactions. The form was redesigned for 2020 which is why it looks different if youve filled one out before then. Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

December 2020 Department of the Treasury Internal Revenue Service. For those employees who furnished forms before 2020 and who do not furnish a new one after 2019 you must continue to withhold based on the forms previously furnished. 2020 Form W4 As the use of paper forms and papers continues for being a staple of business and industrial activities there is a necessity for businesses to create utilization of the W4 form printable.

2020 W4 As the usage of paper forms and papers carries on for being a staple of business and commercial actions theres a necessity for organizations to make usage of the W4 form printable. The W4 form may be used to file all essential paperwork and. Employers Quarterly Federal Tax Return Form W-2.

How to fill out the new 2020 W-4 Form. Employees Withholding Certificate 2021 12312020 Form W-4. Beginning with the 2020 Form W-4 employees are no longer able to request adjustments to their withholding using withholding allowances.

No longer uses allowances tied to the amount of the personal exemptions claimed. Withholding more tax on your Form W-4. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Form W-4 used to be titled Employees Withholding Allowance Certificate But in 2020 that title was shortened to Employees Withholding Certificate. W4 2020 Form Printable IRS Since the utilization of paper forms and papers continues to become a staple of business and industrial activities there is a need for companies to create usage of the W4 form printable. Joint filers have it easier when filling out their W-4.

Your withholding is subject to review by the IRS. Give Form W-4 to your employer. If youre filling out a Form W-4 you probably just started a new job.

Or maybe you recently got married or had a baby. The W4 form printable is accustomed to facilitate an employees withholding of tax funds too as other sorts of payroll transactions. Many Americans see.

The first is the forms title. The W4 form printable is used to facilitate an employees withholding of tax funds also as other sorts of payroll transactions. Update your W-4 form with help from Block.

Give Form W-4 to your employer. Multiple jobs or spouse works. Your paycheck and tax refund are impacted by how you complete your W-4.

Multiply 2000 with the number of qualifying children you have that you can claim Child Tax Credit for and do the same for every other dependent you have but instead of multiplying it with 2000 multiply it with 500 and enter both amounts. Enter the personal information and choose the filing status as single or married filing. Your withholding is subject to review by the IRS.

Note that special rules apply to Forms W-4.